by Curtis Banks | Published 25 Jul 2021 (Updated 5 Nov 2021)

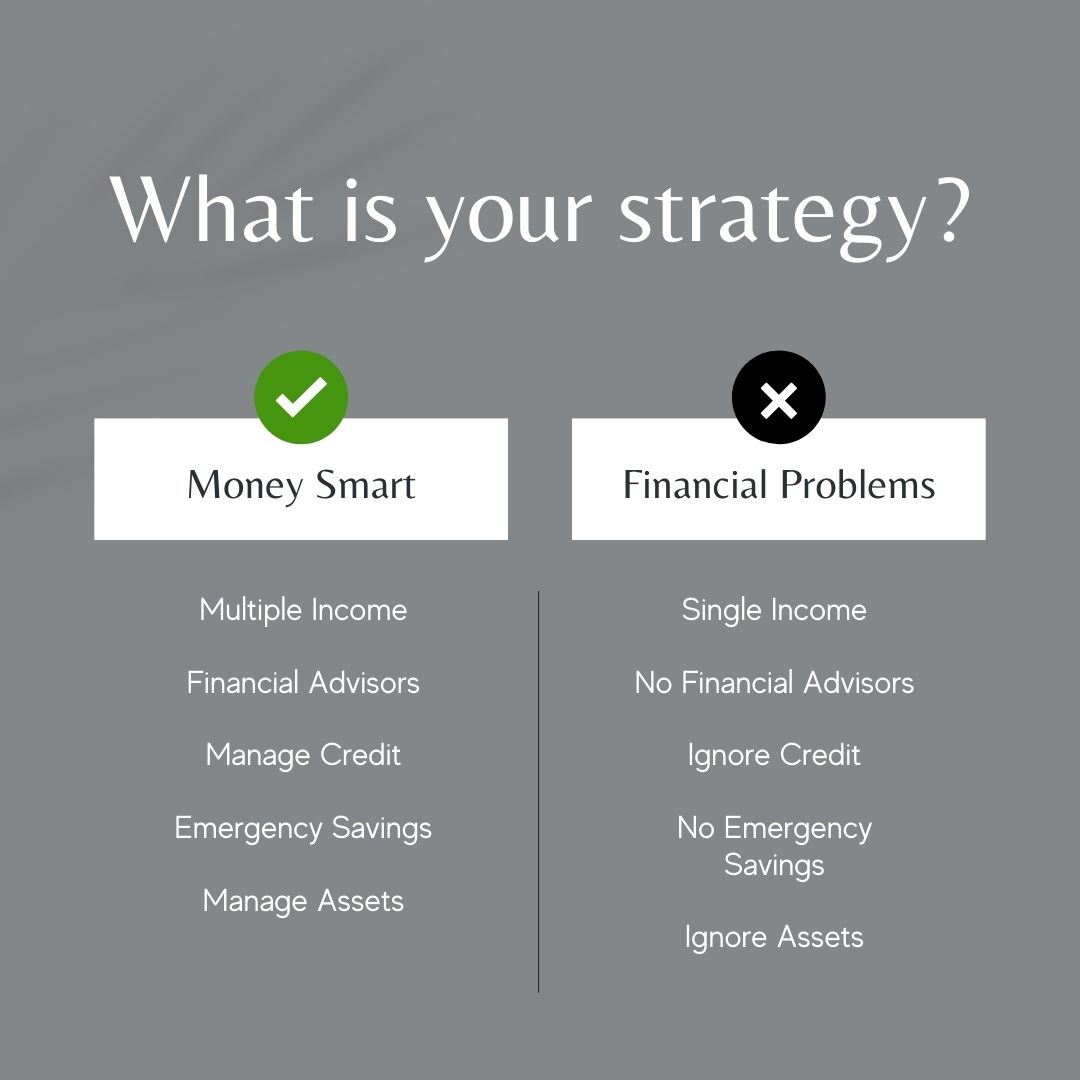

Wealthy people stay wealthy by making sound financial decisions and lifestyle choices throughout their day, every day. The five core areas of your financial health that are impacted by financial decisions and lifestyle choices include income, assets, credit, insurance, and debt. Wealthy people are good at balancing these five areas and thus insulate themselves from financial hardships. We’ll examine the differences between Ashely and Diana’s choices in each area.

Ashley's Story

Ashley is a mother of two working full-time in an administrative support role at a small firm. Like many in her field she makes around $17.41/hour. Ashley is a $0.77 raise away from making it into the 40th percentile of wage earners in the United States. She is just $2.99/hour shy from being able to afford a modest one-bedroom apartment at fair market value according to the National Low Income Housing Coalition (NLIHC). She is also $7.49/hour shy from being able to afford a modest two-bedroom apartment at fair market value according to the NLIHC. Ashley represents 36% of all households in the United States; they are unable to afford a modest apartment at the national average fair market value based on wages. Yet Ashley is wealthy and prospering.

Ashley has created three sources of income for her family: her job, selling online courses, and Air BnB. She keeps a record of her income so that she can reliably predict what she will make each month. Ashley has positive cash flow at the end of each month because she manages her income and expenses. It doesn’t stop there.

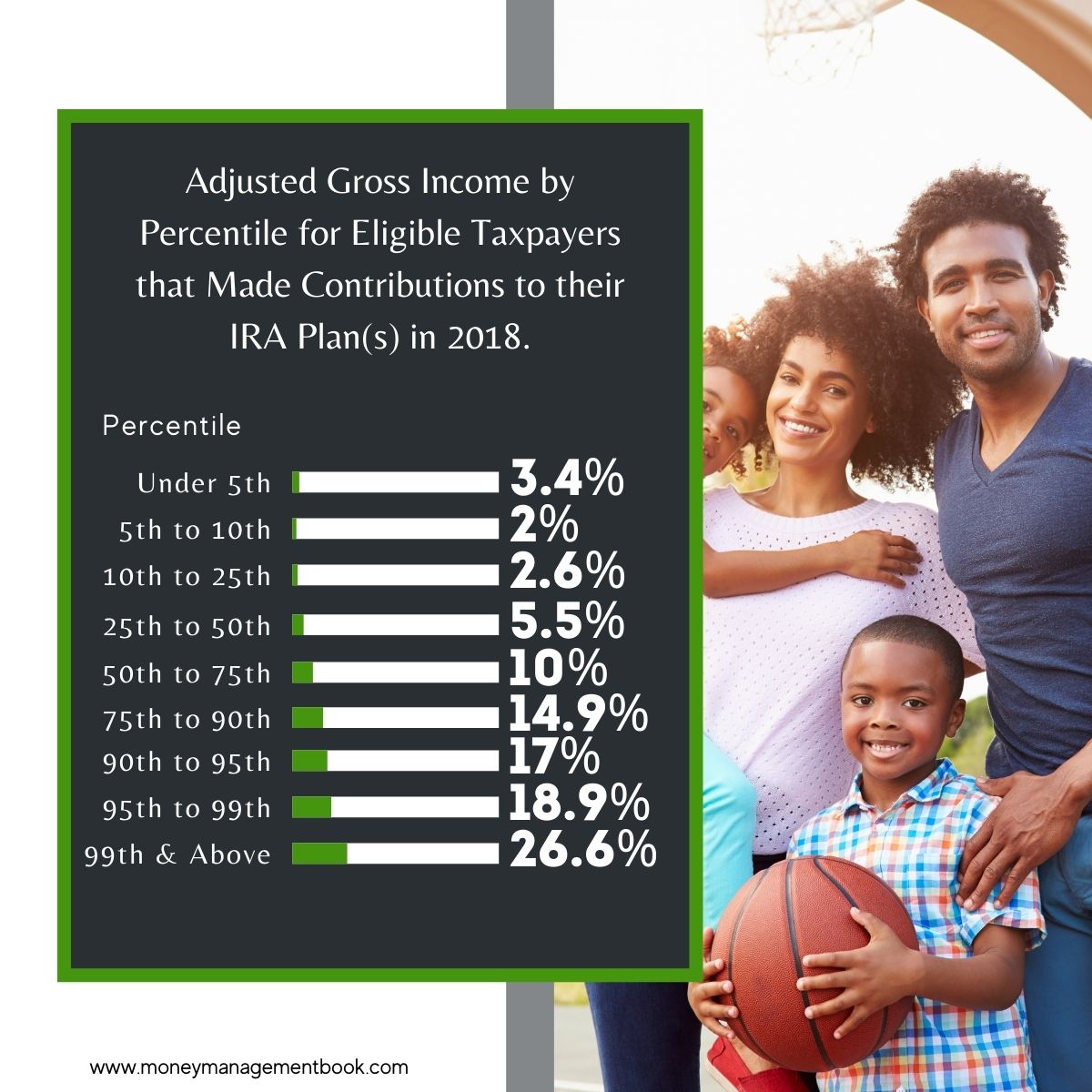

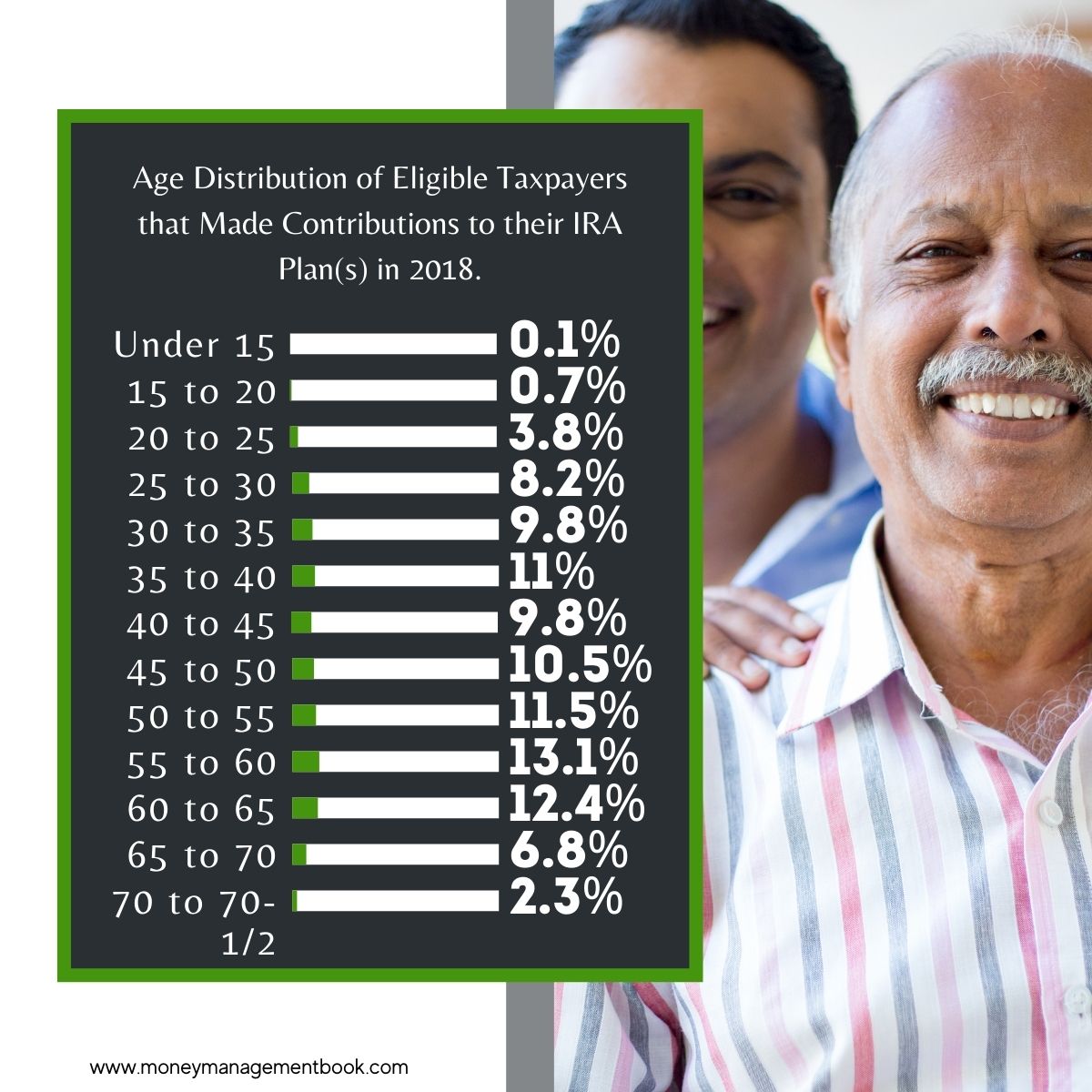

Ashley manages her assets for success. She takes full advantage of the retirement benefits package at her workplace. She meets with a financial advisor regularly to make sure that she achieves her financial milestones. Ashely has emergency funds set aside along with 6 months of living expenses saved up, and she contributes to a college fund for her kids and for herself.

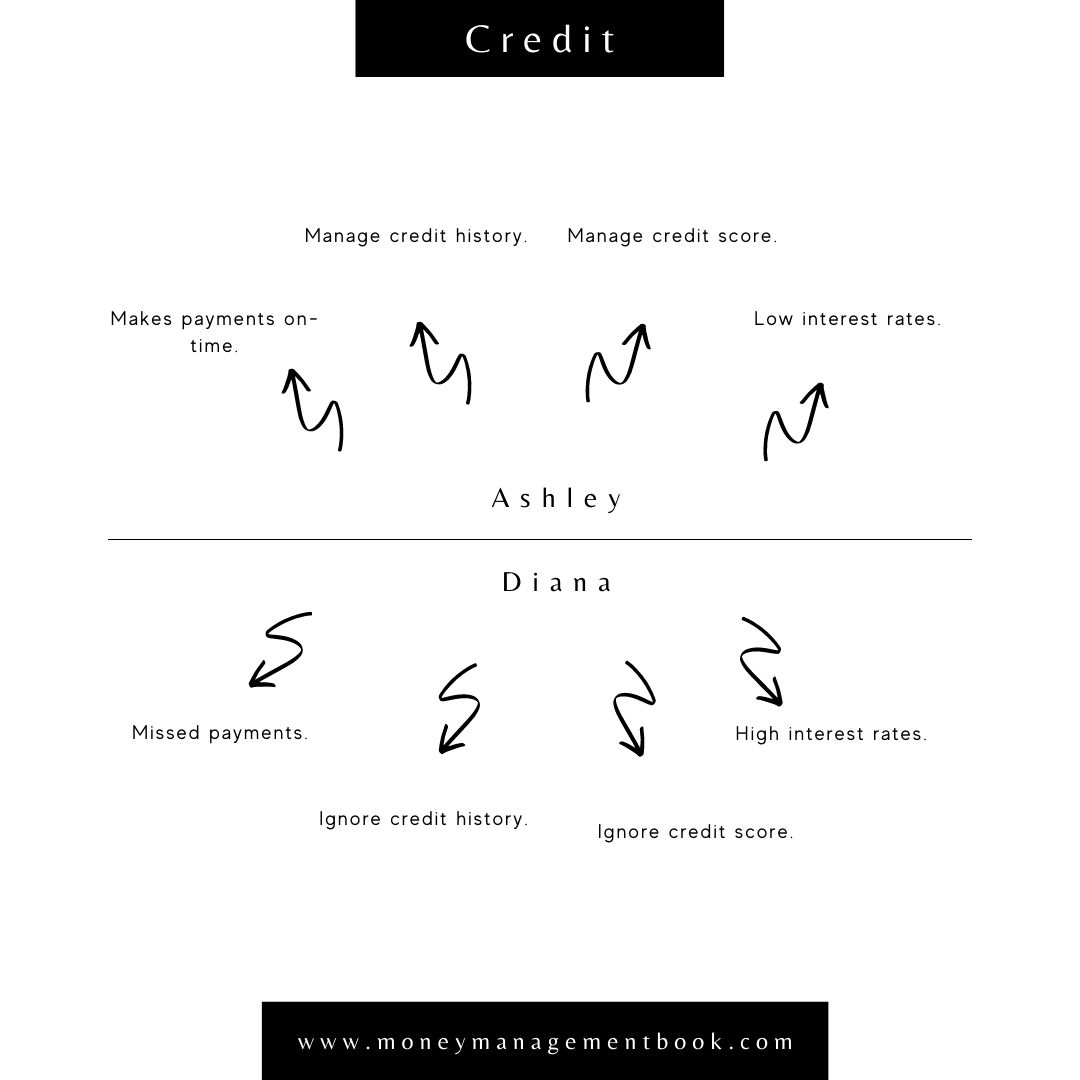

Credit is not an issue for Ashley because she always pays on time. Because she has a good credit score and healthy credit history, Ashley enjoys access to capital at a low interest rate with low payments. Ashley monitors her credit report regularly to make sure that it is accurate and protected from theft.

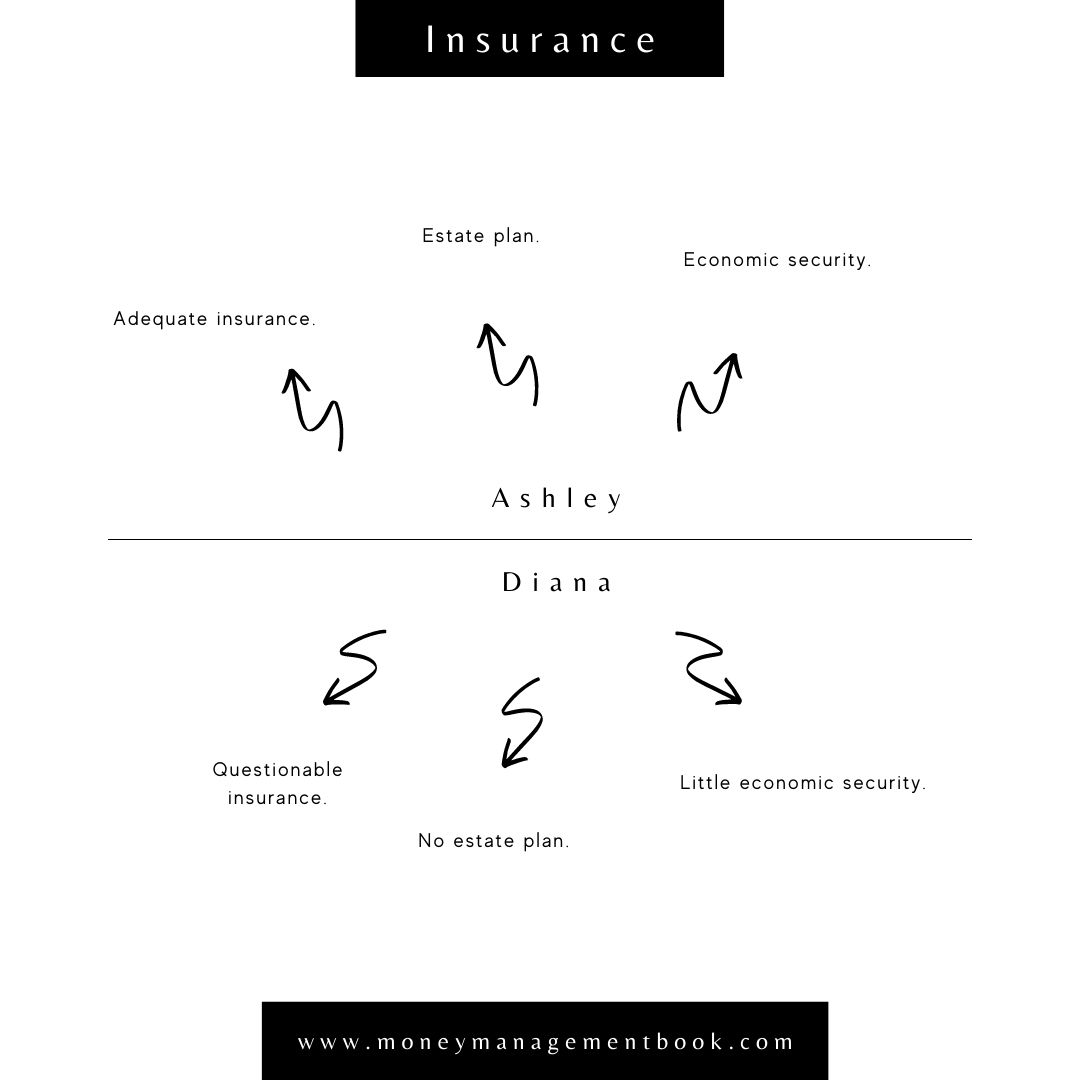

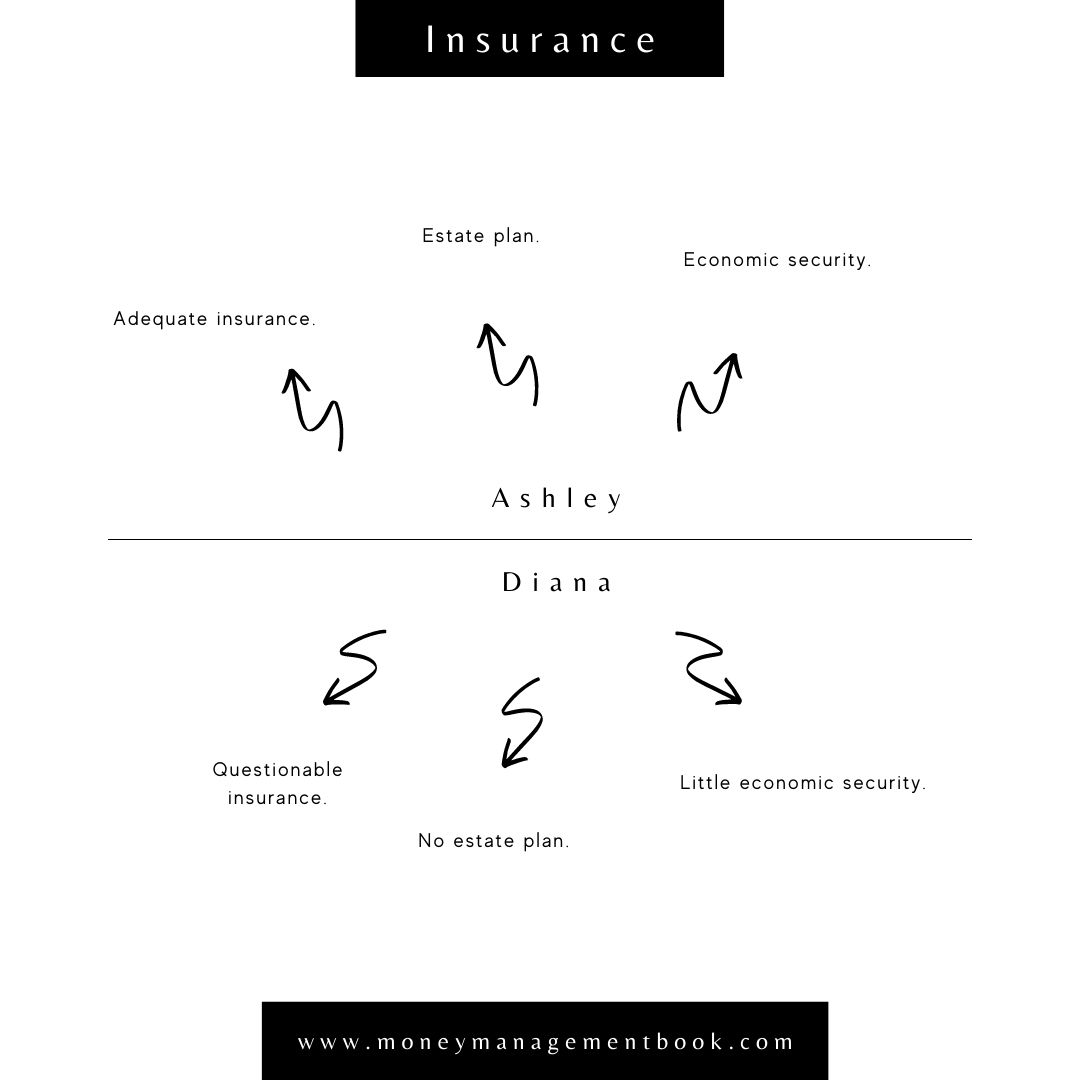

Ashley protects herself and her family with adequate insurance. She has an estate plan and is protected for emergencies. She sleeps easy knowing that her wealth and health are financially insured, and her kids have economic security.

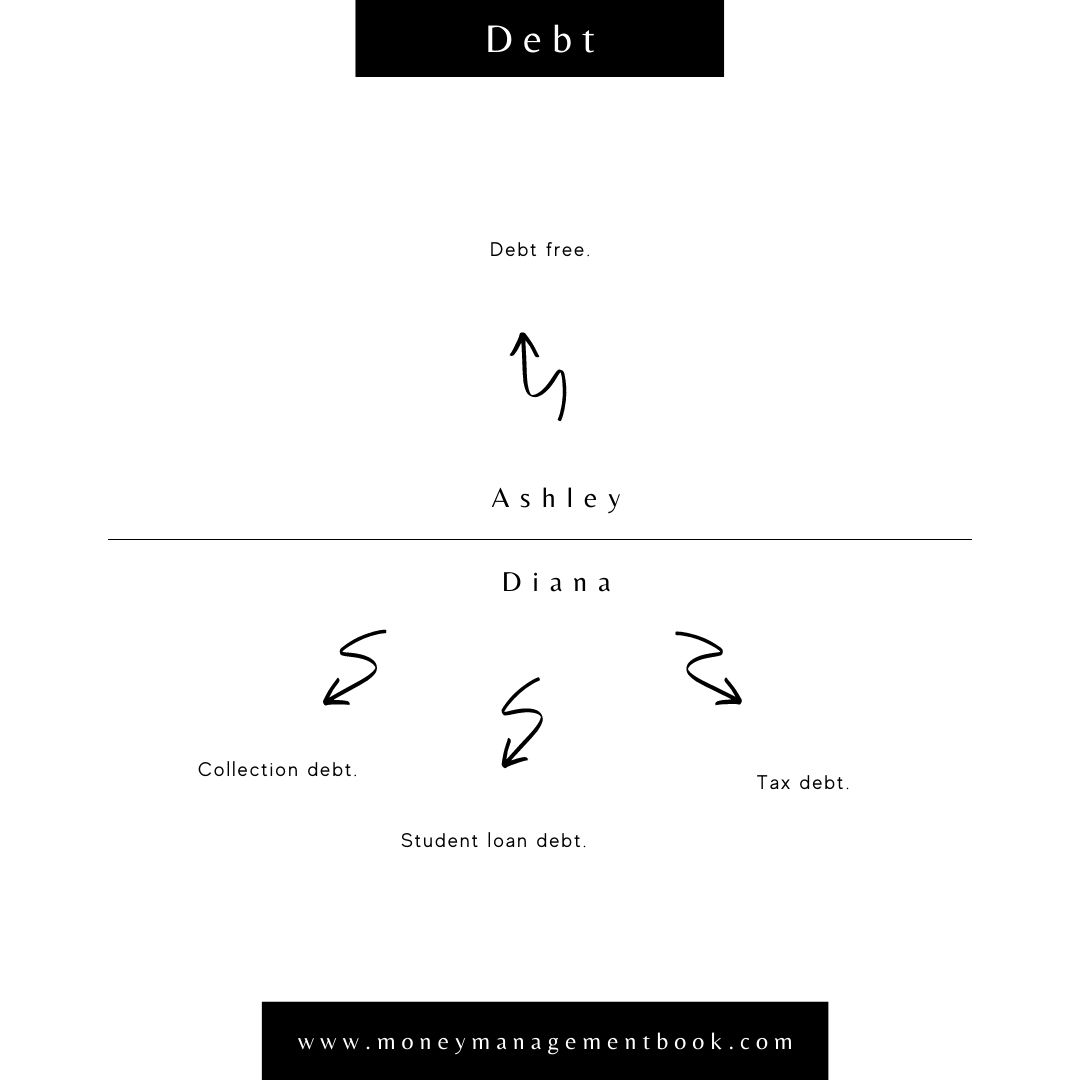

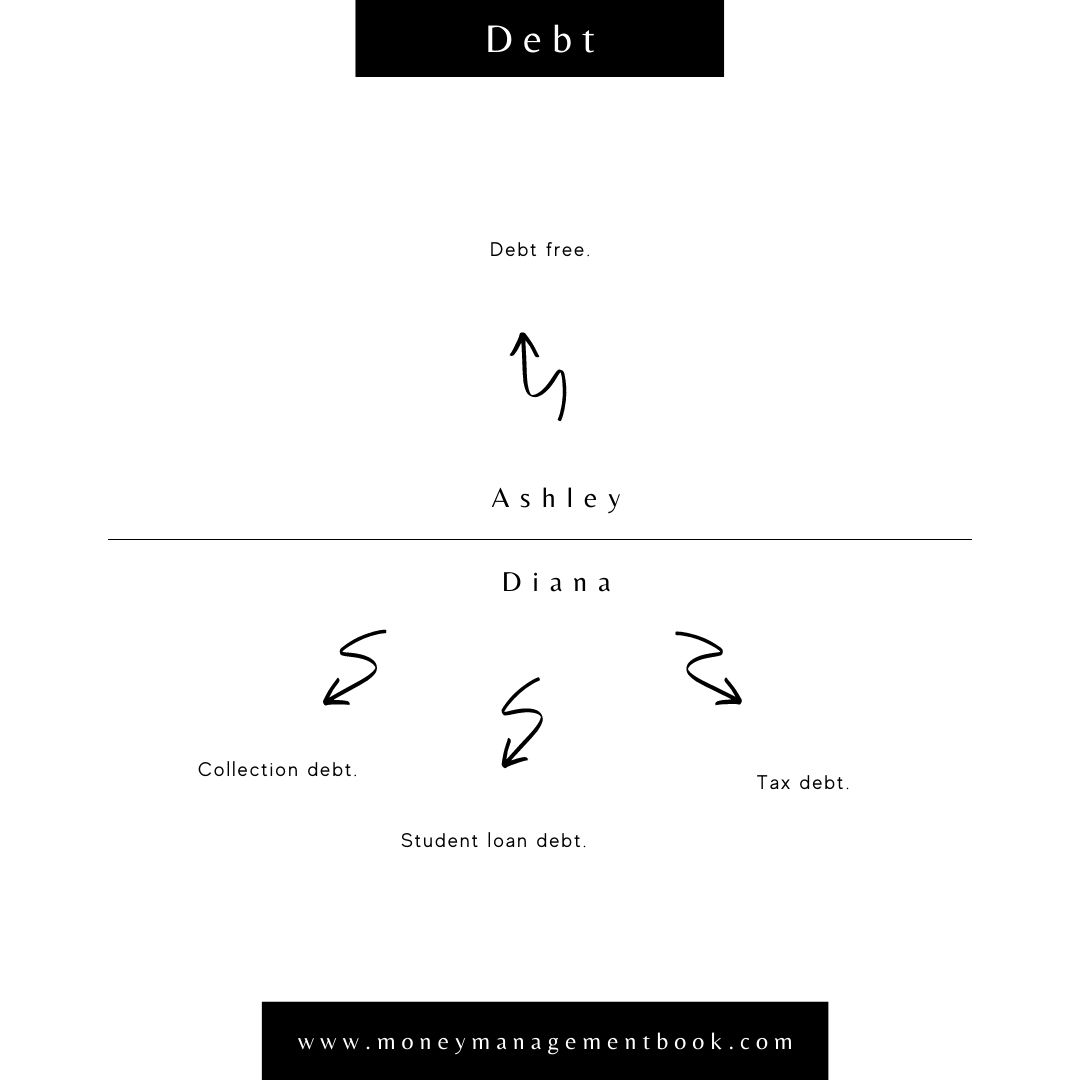

Ashley has no debt on her books. Even though she fits into a category of disadvantaged, she has taken steps to educate herself and protect her finances. Today, Ashley is wealthy and happier because of the choices she made. Diana’s story is a world apart, however.

Enter to Win $25!

Subscribe and share The Book on Money Management for a chance to win a $25 digital gift card.

Diana's Story

Diana works full-time as a psychiatrist and was never interested in having children. Her career brings in around $114.28/hour easily placing her within the 90th percentile of wage earners. Diana’s wages pay more than enough to afford a modest apartment at the national average fair market value. Diana has some huge advantages, but she is far from being wealthy. Let’s see why.

Diana has a great income from her job. She currently has one income source, and the payments are predictable. Diana likes to go out when she can and spends a lot on volatile investment opportunities. Sometimes it causes her to have negative cash flow at the end of the month, but it doesn’t bother her because she bounces back quickly. Diana has a little bit of trouble with the IRS, but she’s currently on a payment plan.

Diana does some things right with her assets. Her retirement is fully funded. However, she doesn’t meet with a financial advisor. Diana is so confident about her income that she only has 1 month of living expenses set aside. Continued education isn’t a big financial goal for Diana, so she doesn’t set money aside for it.

Credit is a sore spot for Diana. She has a habit of missing payments 1 or 2 times per year and has some unresolved collections from her college days. She doesn’t know this because she stopped checking her credit report years ago. It’s just something she never bothers to do.

Diana has some insurance, but she never spoke with experts to make sure it was the right insurance with adequate protection. She just went with the cheapest insurance she could find in order to check off some boxes. Couldn’t happen to me she thinks to herself. Diana thinks it’s a good idea to have an estate plan, but she has never taken action.

Aside from the collection debt that she is unaware of, Diana has student loan debt and tax debt. Her credit card utilization is high, and she pays more on high interest than she should be. Diana has yet to speak with a financial coach or financial advisor to make a plan.

Recap

Ashley and Diana are two people on opposite sides of a financial literacy spectrum. Financial literacy makes a big difference in how we handle money. Let’s explore how even though Ashley has a disadvantage in wages, her financial acumen, attitude and choices have put her in a better position than Diana. Finally, we’ll look at how Diana can make changes that will level the playing field.

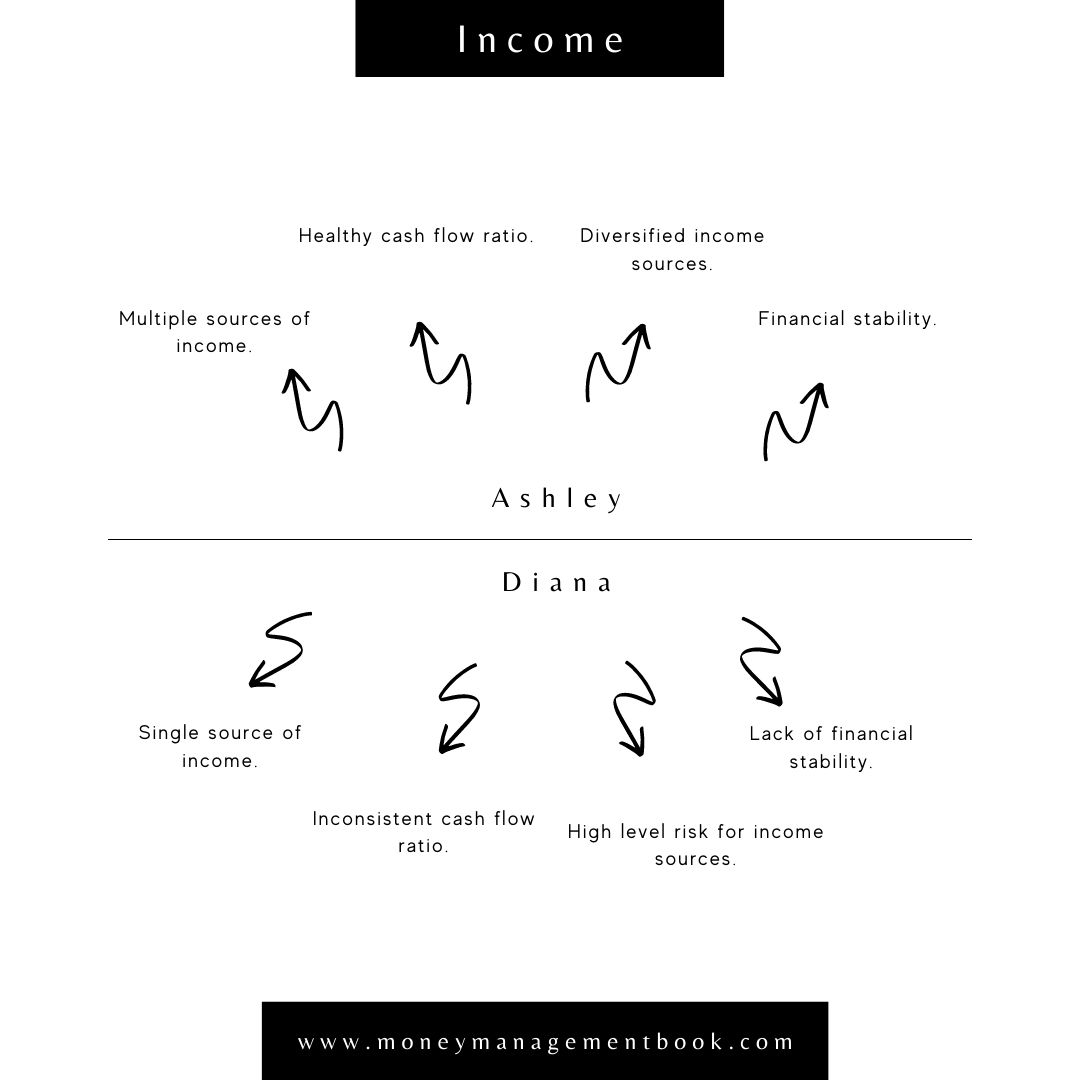

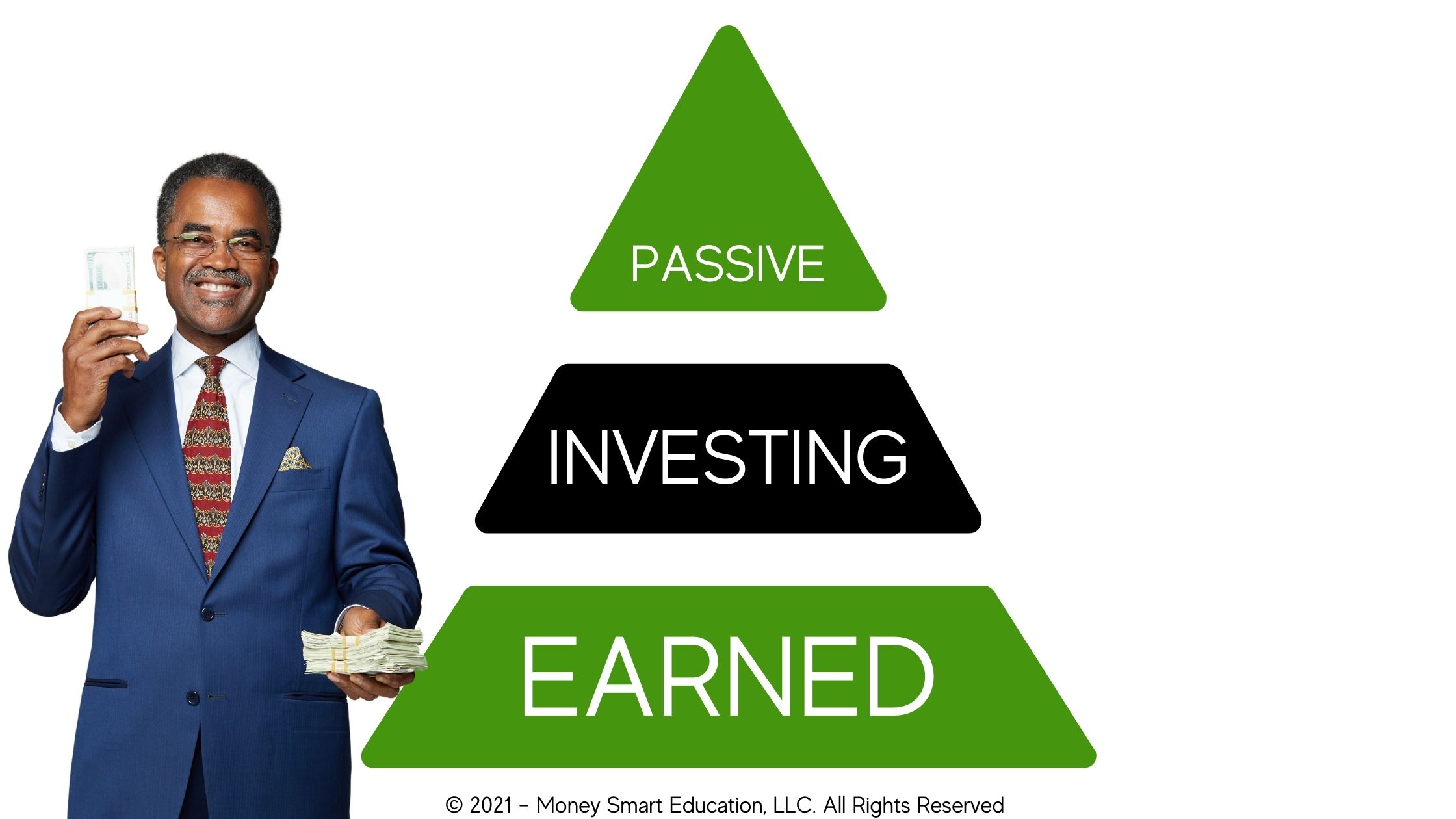

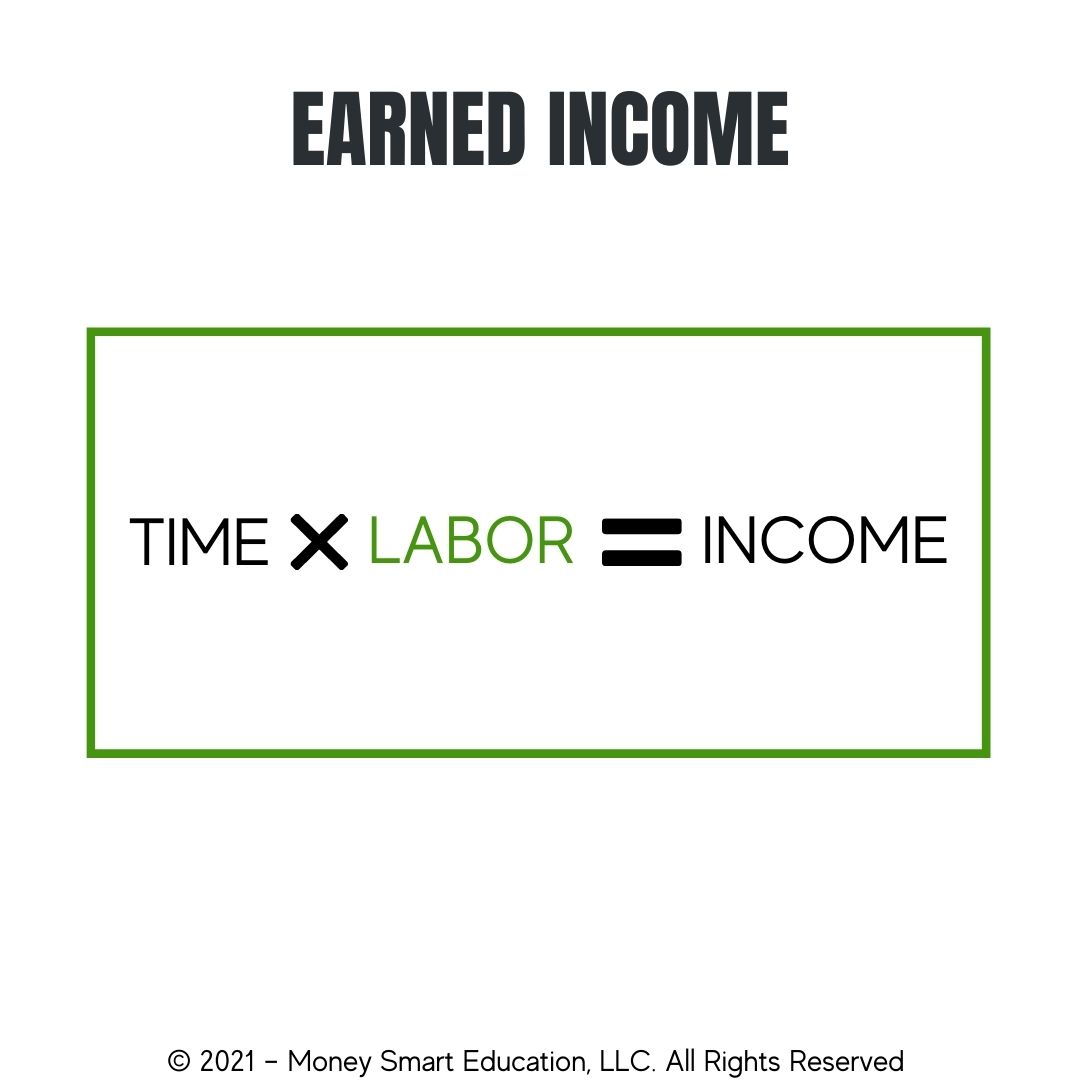

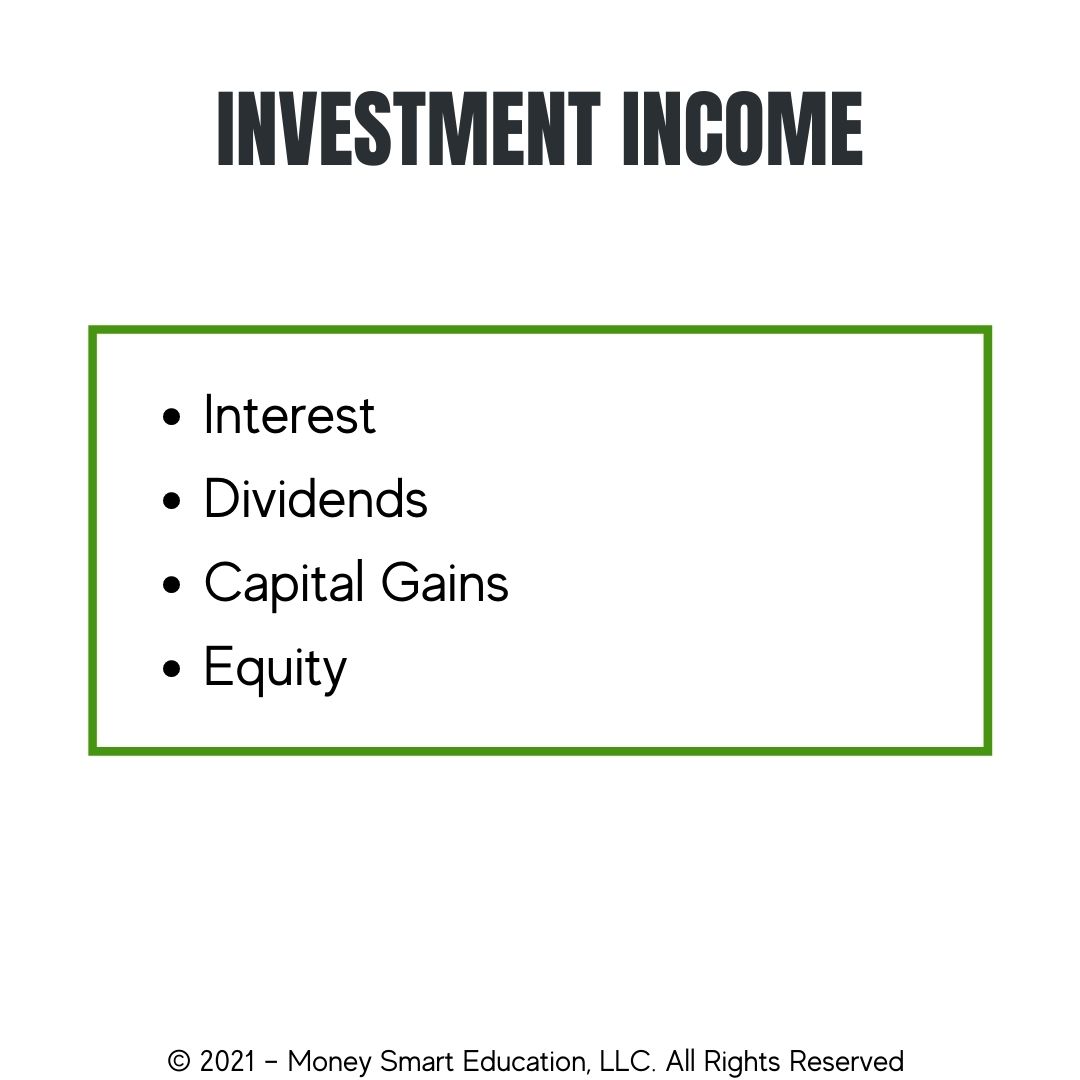

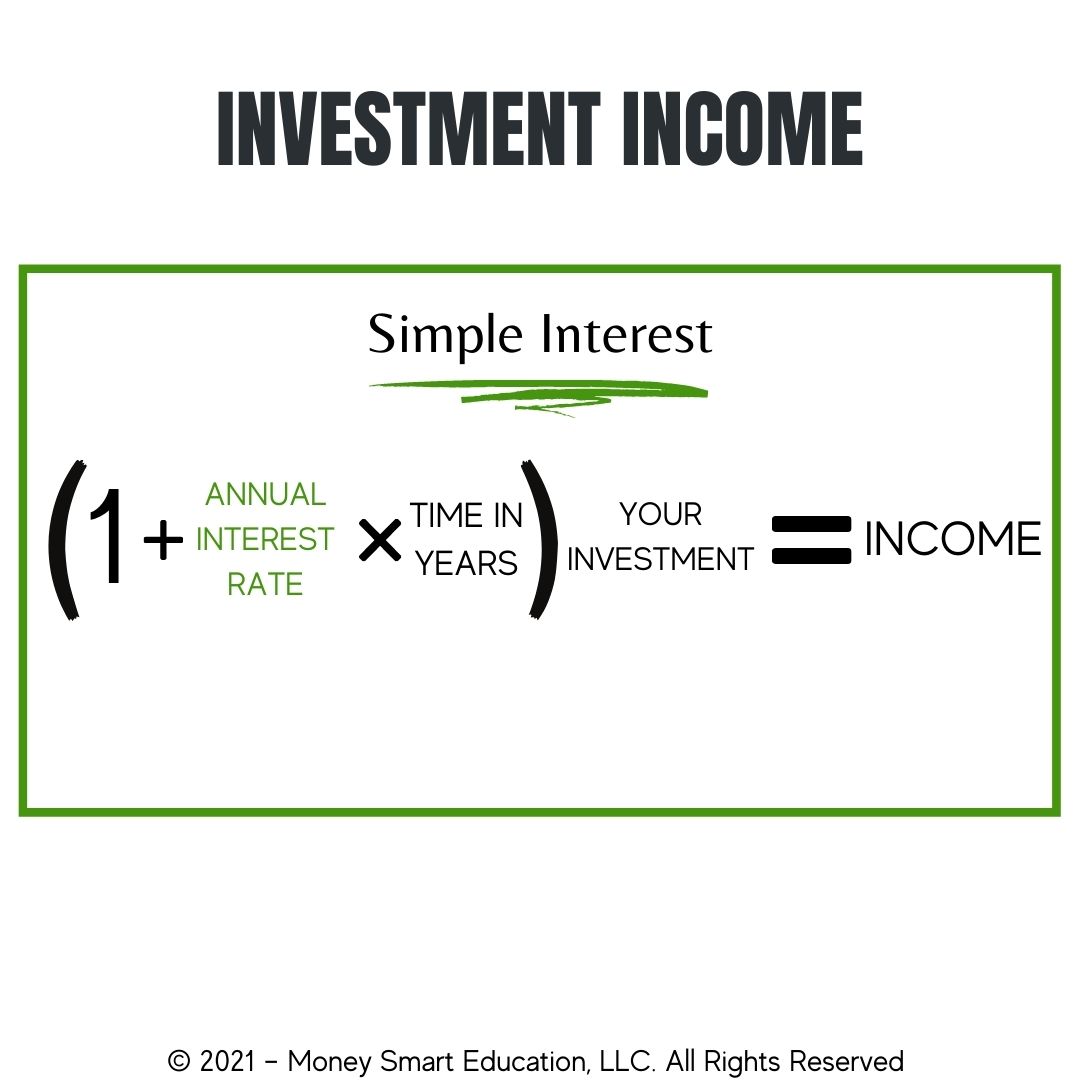

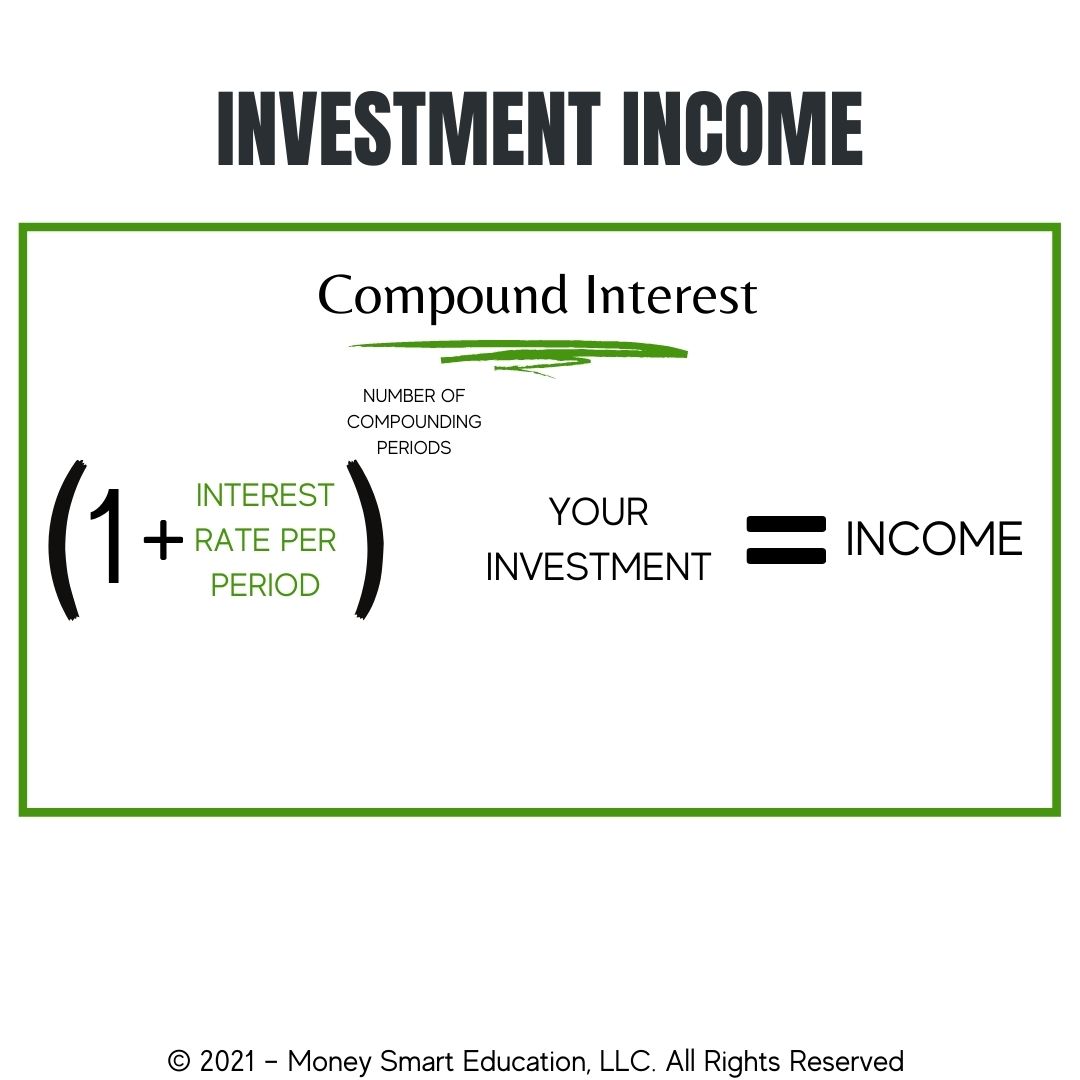

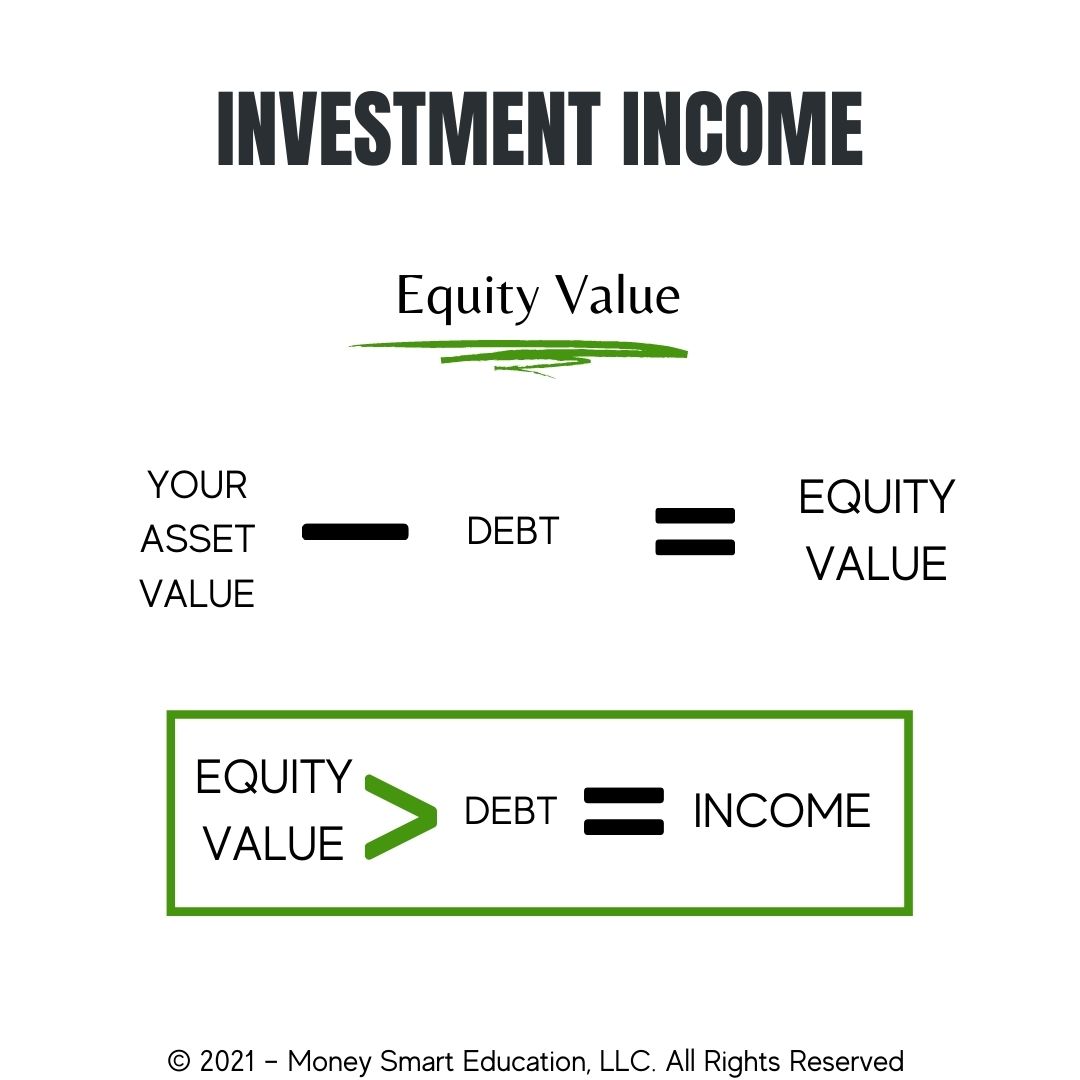

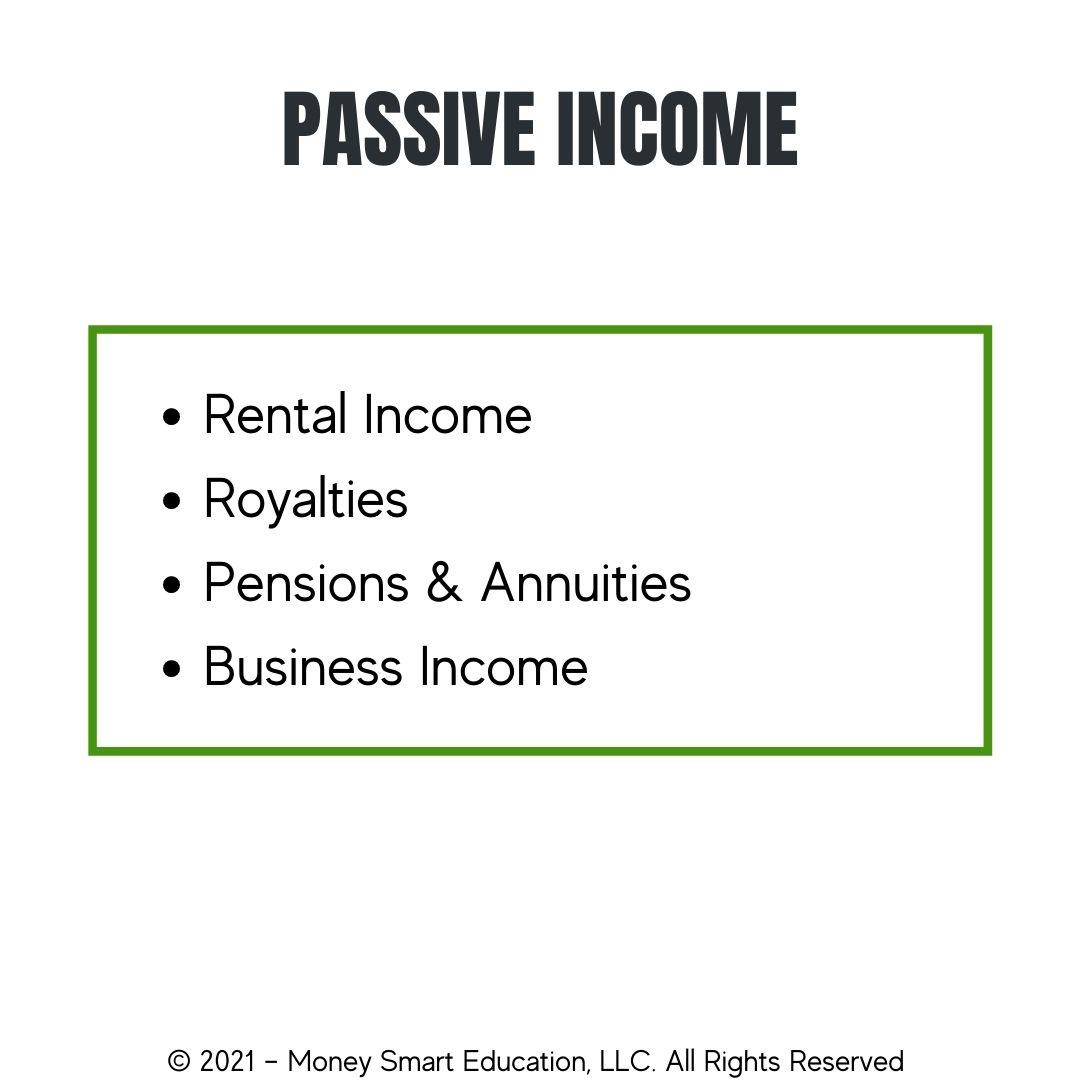

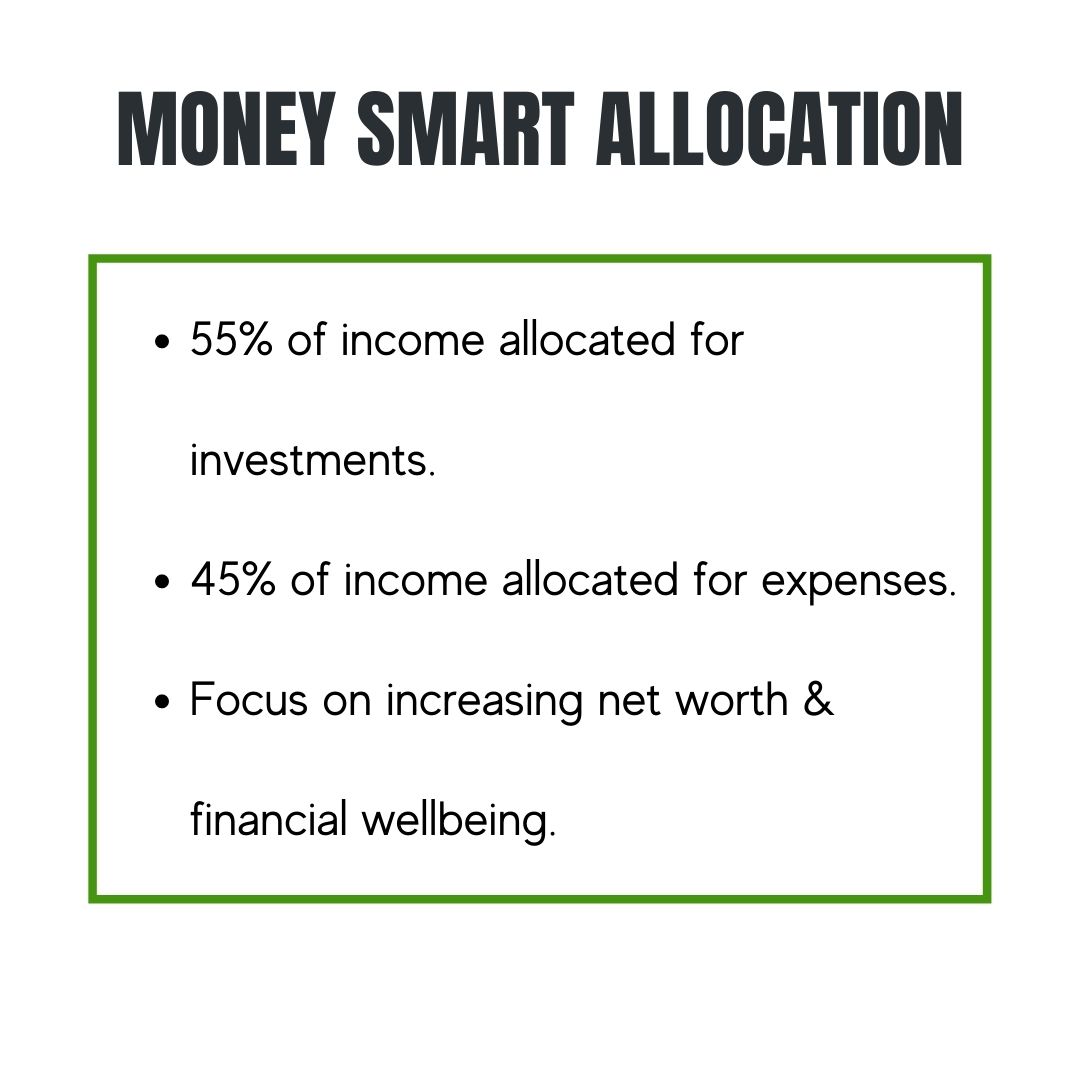

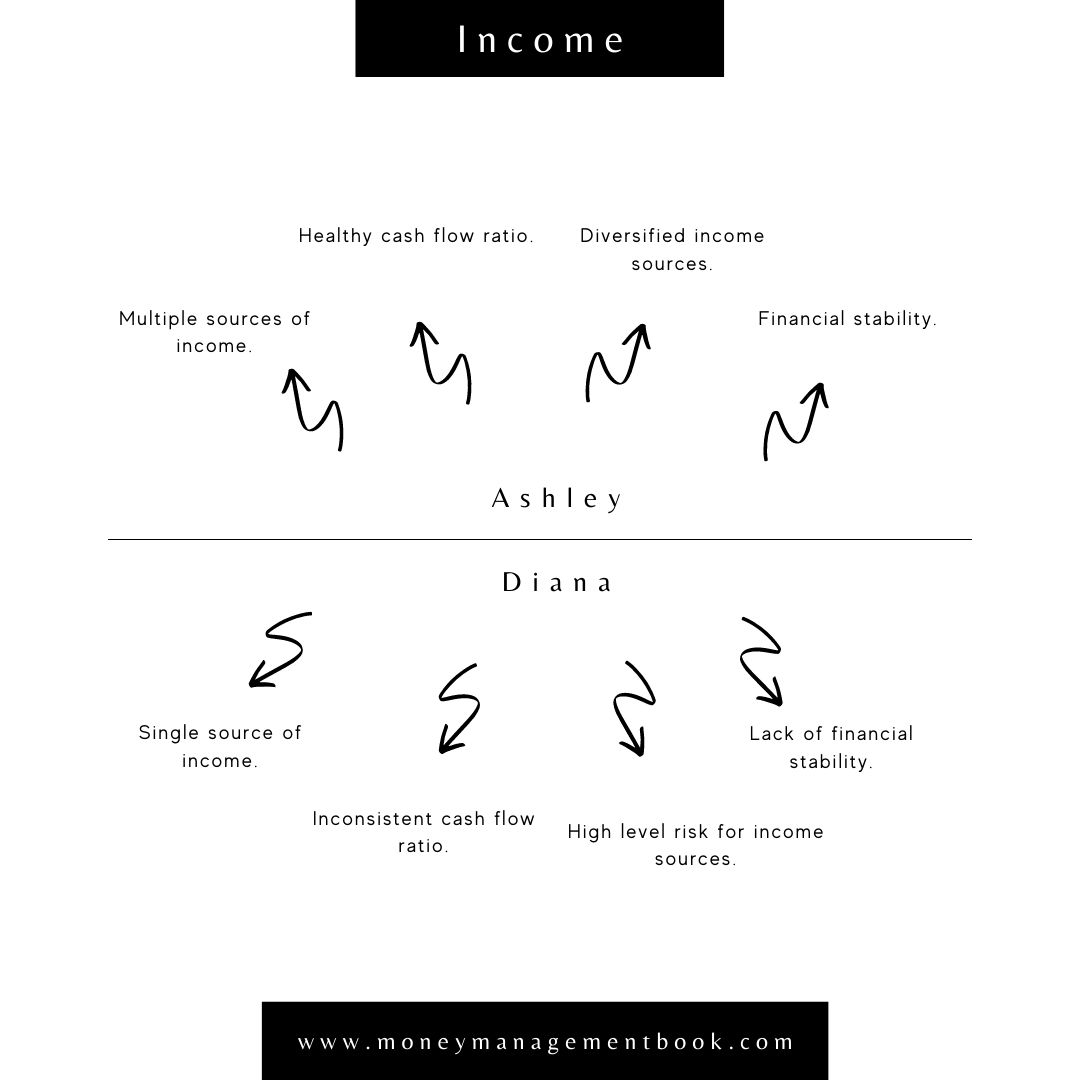

Income

The Money Smart approach to income is to have multiple sources, know when it’s coming and how much you will make after taxes, and manage income using the Money Smart Allocation system to maintain a healthy cash flow ratio. Even though Diana has a higher paying wage than Ashley, it is clear that Ashley’s income is diversified, and Diana’s income is not diversified. If Ashley lost her job today or was unable to work, she has income from her online courses and Air BnB that she can rely on. If Diana lost her job or was unable to work, her income would stop. See the difference?

Having a high paying job is great but having multiple streams of income is building wealth. Ashley should continue creating more and more streams of income. The more she creates, the better off she and her children will be. Diana would be far better off setting goals to create and nurture new streams of income each year. By doing so, she too can build wealth.

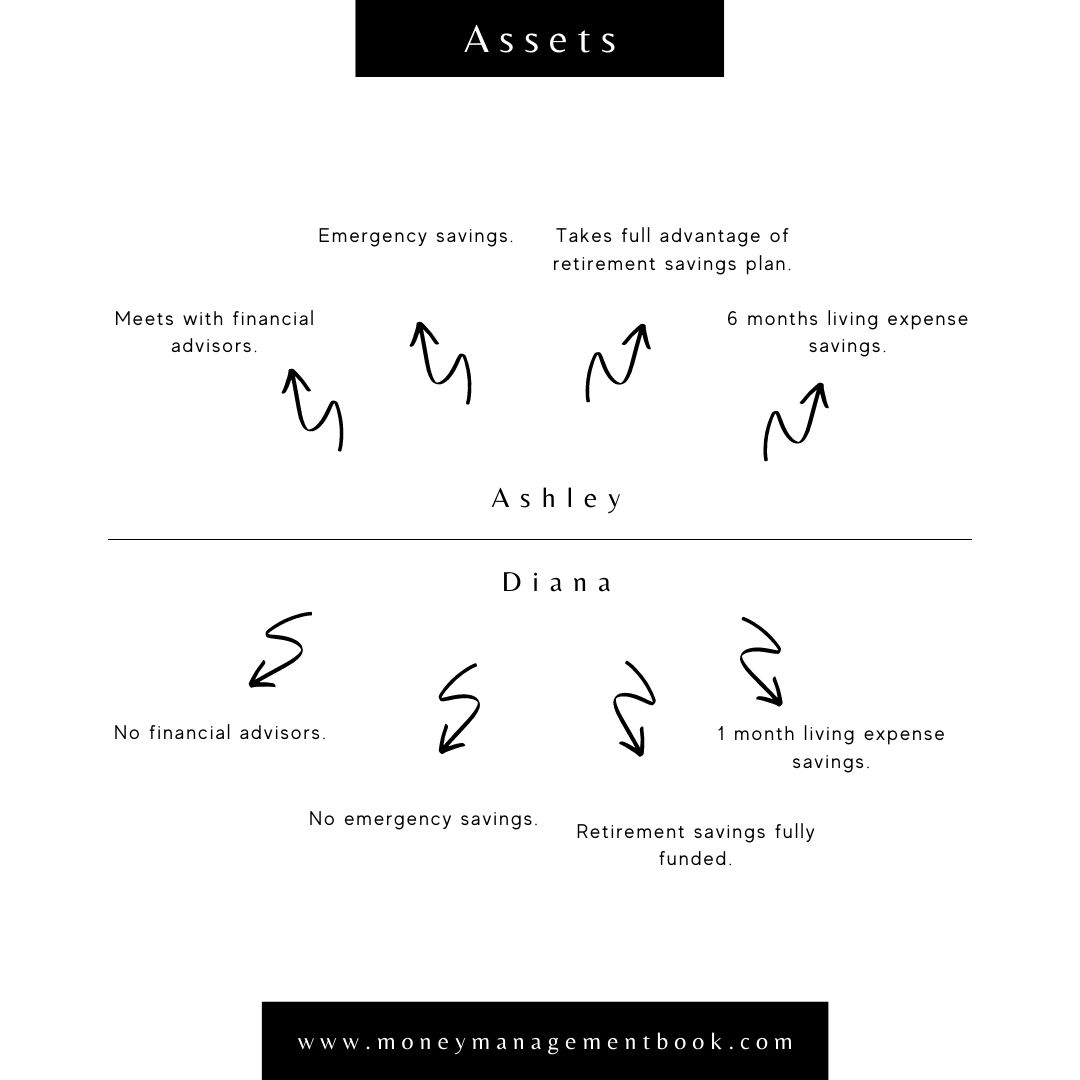

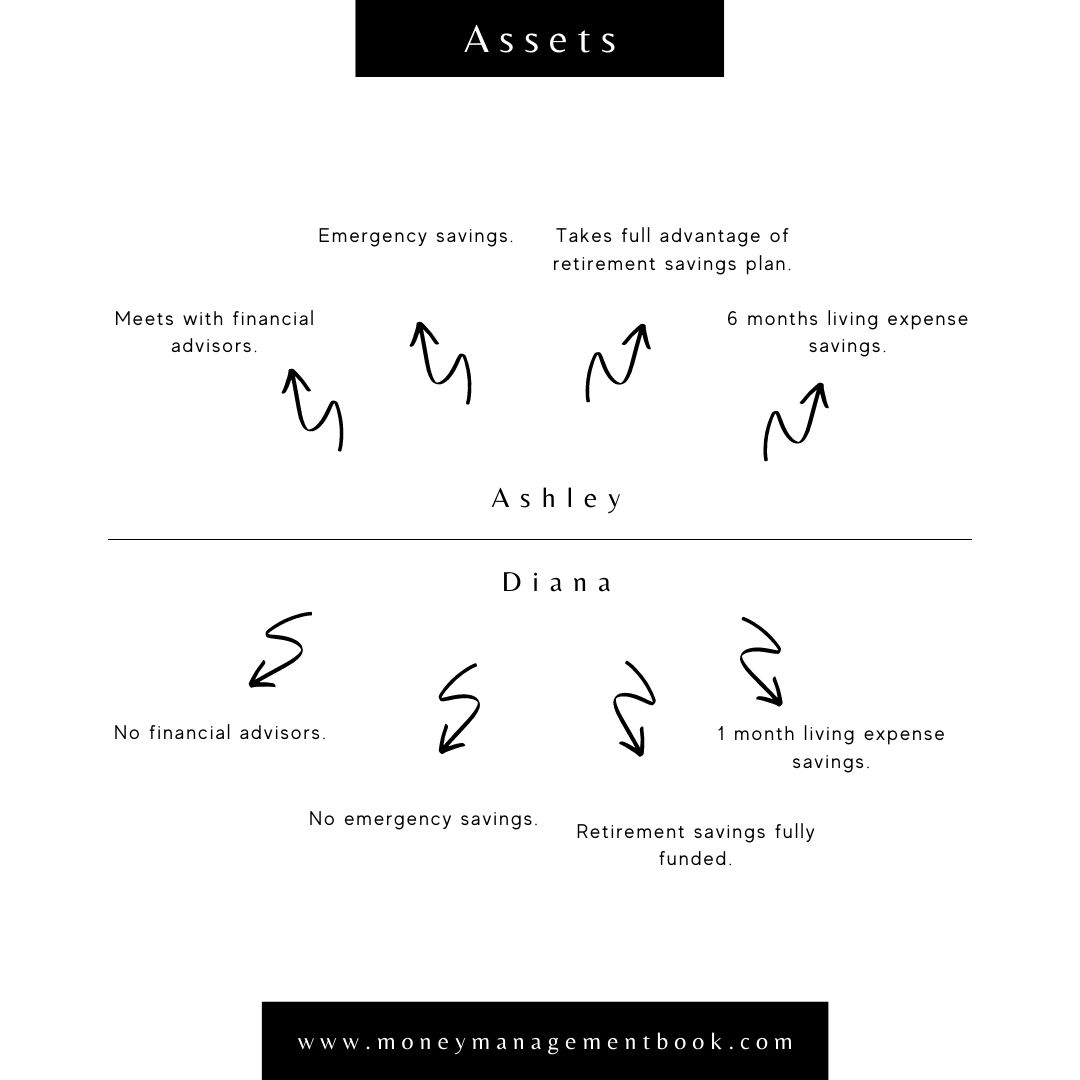

Assets

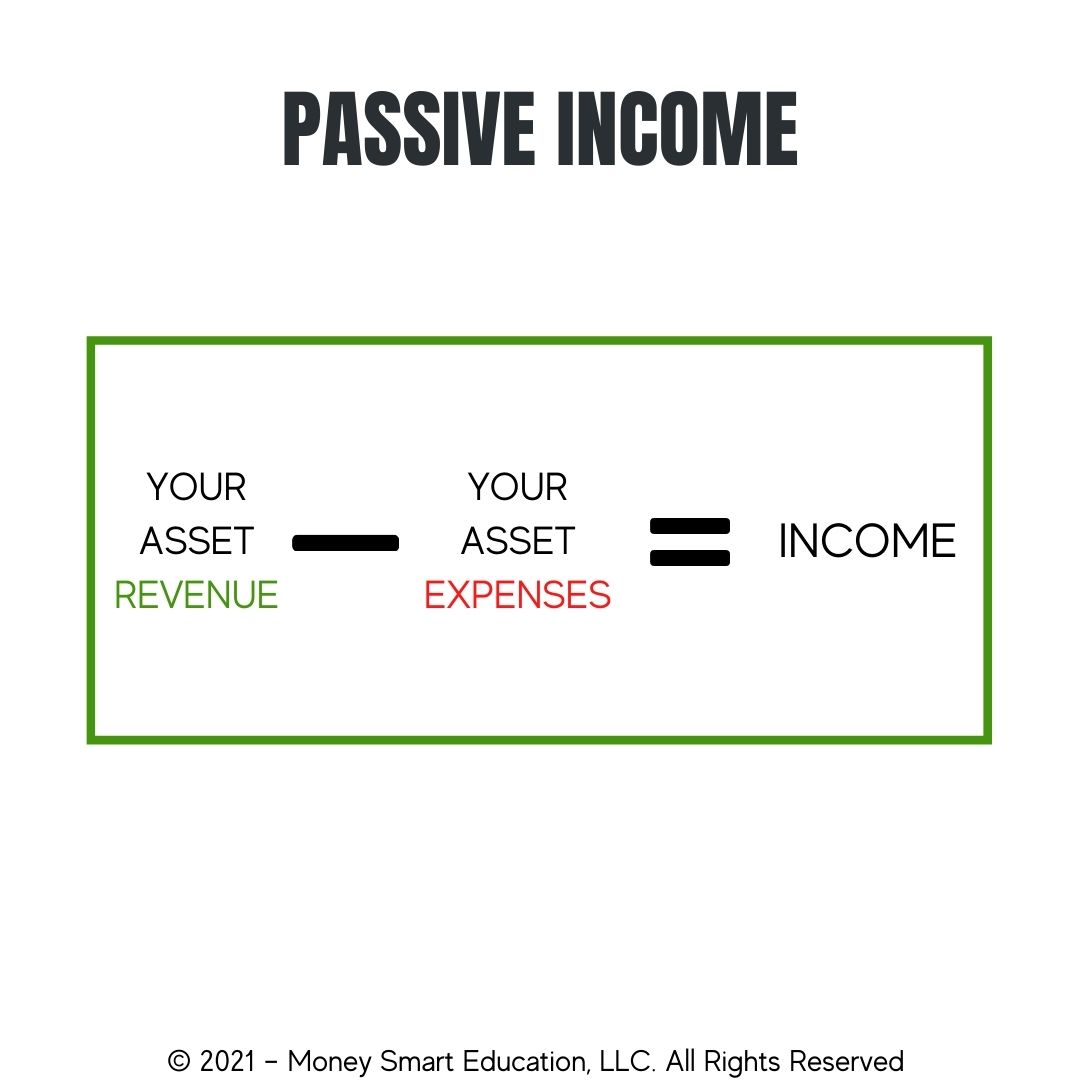

It’s Money Smart to buy assets that produce positive cash flow! The same is true for growing your net worth, and it’s hard to do that without assets. There are experts who sell financial products that we can use to build wealth. We call them financial advisors. One of the key differences between Ashley and Diana is that Ashley met regularly with financial advisors to ensure she was getting good results with her assets. One area where Ashley could improve is to work with her financial advisors to focus on assets that will generate more positive cash flow for her. Ashley’s choice to have one account for her emergency expenses and one account with 6-months of living expenses is also Money Smart. As for Diana, her overconfidence in her current wages is causing her to make risky financial decisions.

Since Diana only has 1-month worth of living expenses saved up, she is more at risk of financial instability than Ashley. The more money Diana saves to cover her living expenses, the more time she will have to recover from a job loss or stay in retirement. Diana also doesn’t have any money set aside for financial emergencies. What will she do in the event of an emergency? She will likely dip into the money she has set aside for living expenses or put it on a credit card. Diana would benefit from working with a financial coach or mentor to make a plan and get her assets in order before disaster strikes.

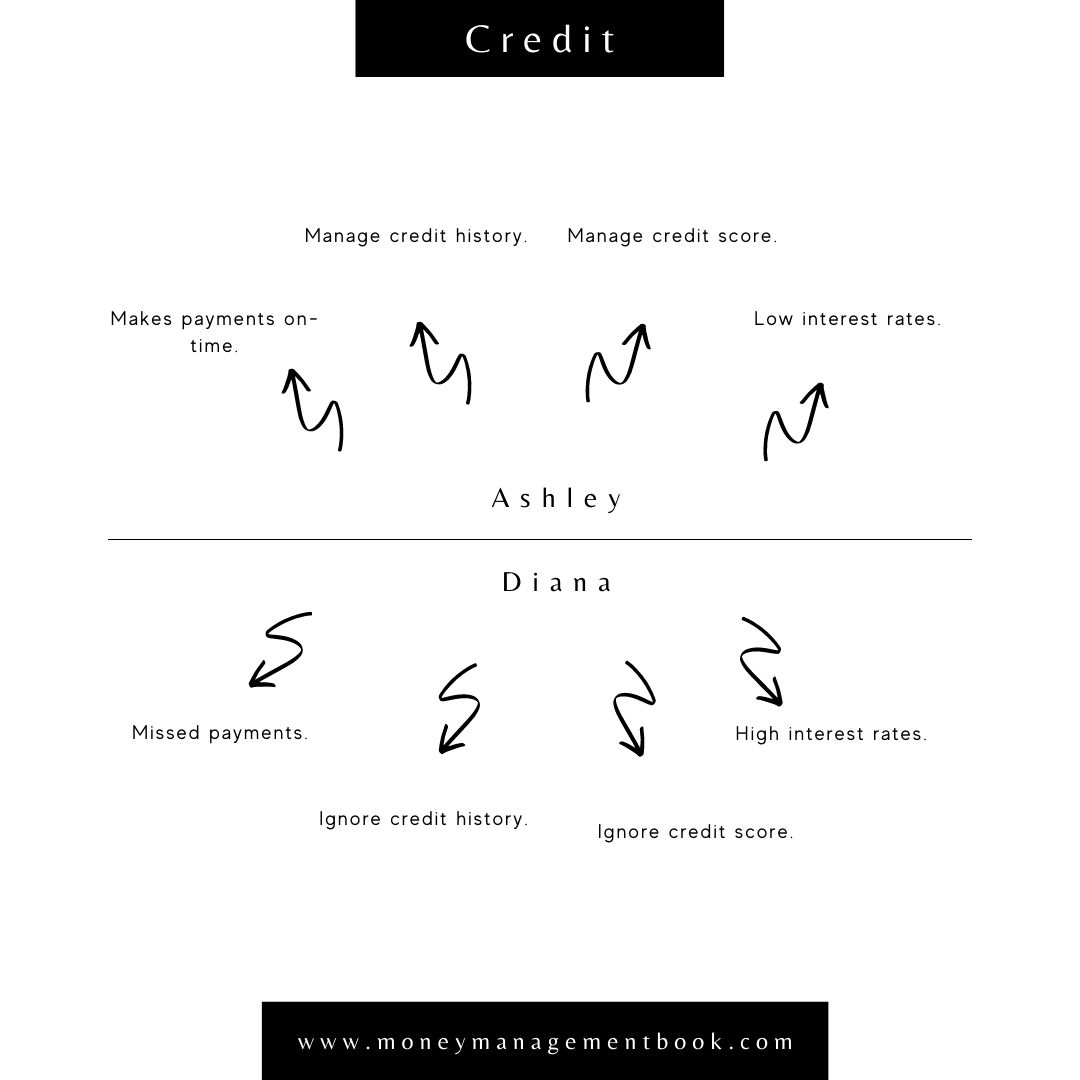

Credit

Someone who is Money Smart makes sure that their credit history is accurate and that their credit score is high because they expect the best. Ashley does all the right things to increase the likelihood that people will lend her money; her decision to have more assets, no debt, and good credit puts her in a strong position. Diana has made some terrible financial decisions by choosing not to review her credit history or credit score on a regular basis. Had she taken a look, she would know that she has a collection on her credit report.

Today, there are a variety of free, paid, and complimentary services available to monitor your credit history and credit score. You can access many of them through your bank on your smart phone or computer. That’s why it’s difficult to find a valid reason for not knowing your soft credit score range or your credit history. Diana would be able to make much better financial decisions if she were informed. Leveling the playing field for Diana will involve taking a good look at her credit report and taking action to clean things up.

Insurance

The Money Smart approach to building wealth includes protecting wealth! Insurance is designed to provide an extra layer of protection between you and financial instability. Because she works with her financial advisors often, Ashley is able to select insurance that adequately protects her and her family. In the event that something happens to her, Ashley’s affairs are in order. The same cannot be said about Diana.

Diana did not consult financial advisors when choosing her insurance. She went for the cheapest solution she could find to get it out of the way. While she does have insurance, it’s not clear whether Diana’s insurance is adequate for her needs. It’s safe to assume that her wealth is not protected. Furthermore, her loved ones would be left to chaos because chose not to plan her estate. Diana could easily level the playing field by taking her insurance more seriously and planning her estate.

Debt

It’s Money Smart to grow assets and reduce liabilities. It’s Money Smart to grow income and reduce expenses. This is because liabilities decrease net worth and expenses decrease cash flow. Wealthy people grow their net worth and have a healthy cash flow ratio. Ashley currently has no debt. The best thing that she can do is continue to keep her debt low so that her net worth can continue to grow. Diana’s situation is quite different.

Diana has debt that she is unaware of! This is why it is so important to monitor your credit report at least once a month. Diana also has tax debt and student loan debt she must worry about. If Diana wants to level the playing field, she will need to start learning from financial educators, coaches, and speaking with financial advisors. Only then will she have enough information to make a plan and correct course.

Leveling The Playing Field

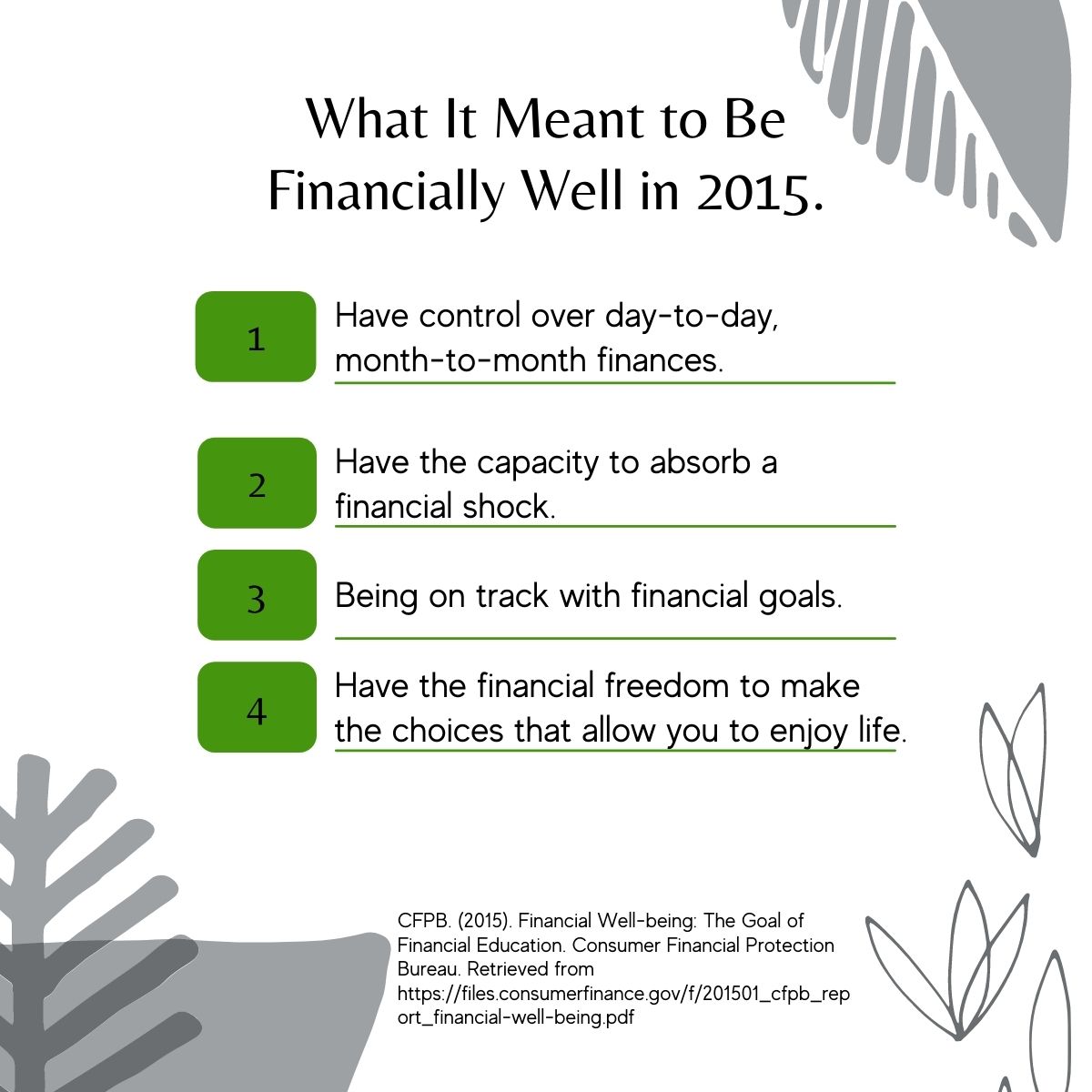

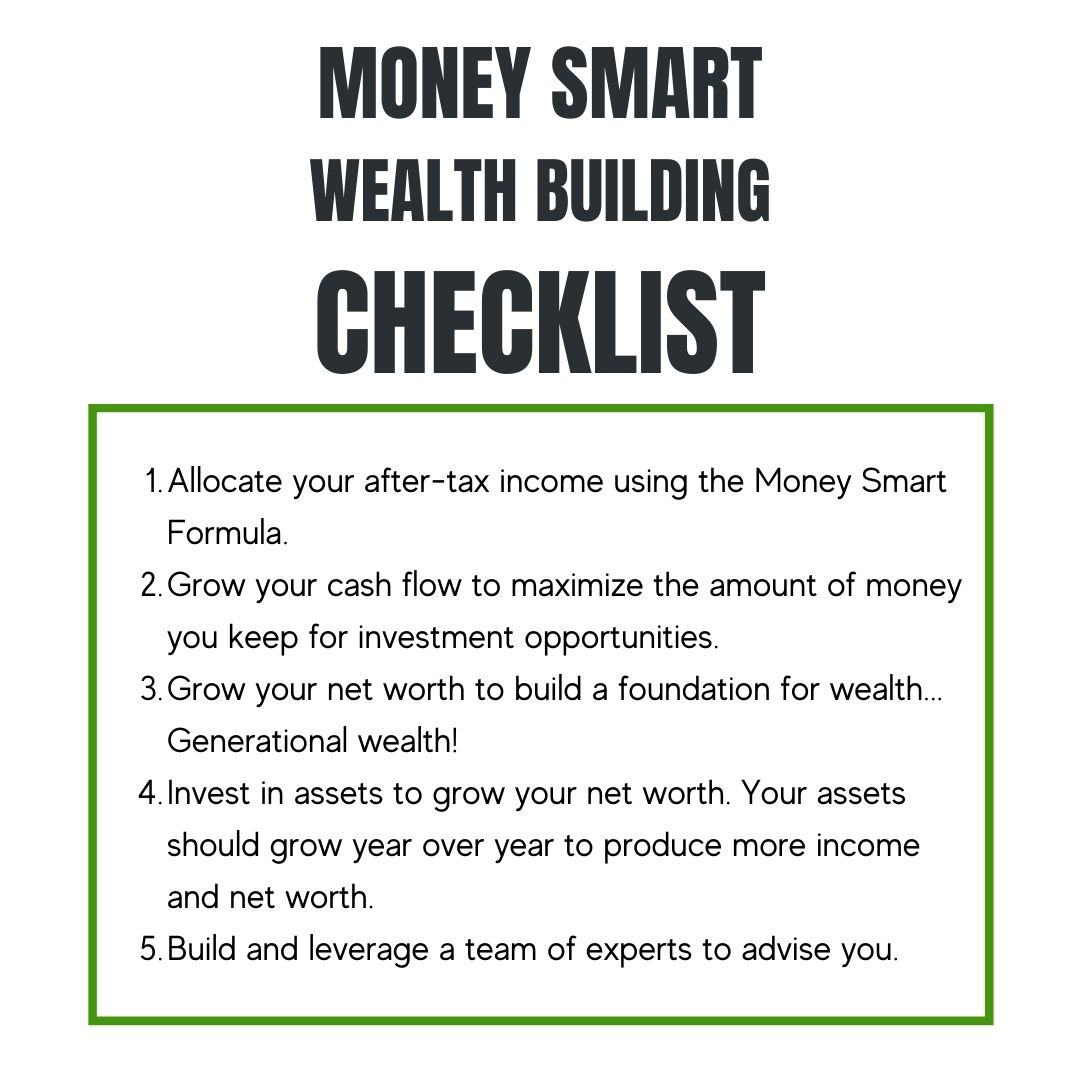

Wealthy people stay wealthy because they maintain their financial literacy, have a clear financial vision and clear financial goals, consult financial experts, maintain and attitude and lifestyle choices consistent with building wealth, and manage their finances to grow their net worth and increase cash flow. It all starts with your financial literacy and your attitude/beliefs about money. Think about what position you would want to be in when a financial emergency comes up. Would you rather have the kind of financial stability that Ashley and her family enjoy, or would you rather take Diana’s risky approach to finances and say YOLO?

A financial educator is the gateway to better financial decisions and more financial stability. That’s because a financial educator’s job is to get you off the sidelines so that you can take a proactive role in your own personal economy. You are the CEO of your life and your personal economy. Take a moment to reflect on the 5 core areas of your personal economy. Are you managing your income like a wealthy person? How are you managing your assets? Are you managing your credit to build wealth? Are you managing your insurance like a wealthy person? Are you managing your debt like a wealthy person? One of the best decisions you can make is to connect with a financial educator or a financial coach/mentor.

While my role as a financial educator is to motivate you take action, my role as a financial mentor is to focus on you, your uniqueness, and connect you with financial resources and financial advisors. You’re here to learn how to build wealth and continue building wealth, and I’m here to facilitate your goals goals through Money Smart Pivot. Money Smart Pivot marries financial education, implementation, and 1-on-1 mentoring together to elevate your personal economy. Put yourself in a position to take action in your personal economy and build wealth.