7 Inspirational Ways to Create Passive Income

by MSE Staff | Published 11 Jul 2021 (Updated 5 Nov 2021)

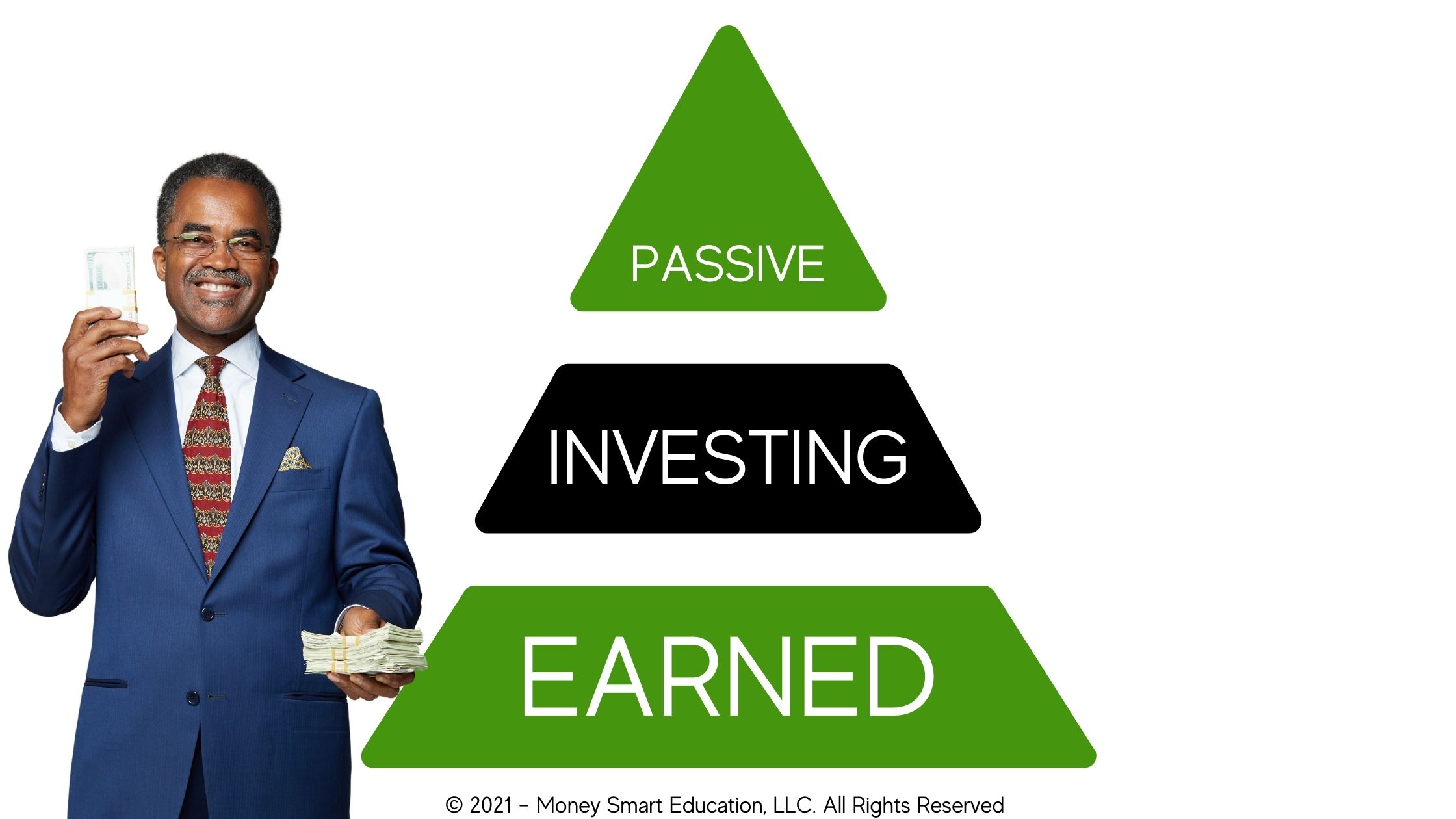

Imagine having a carefree day going to the places you like to go, doing the things you love to do, and feeling fantastic about it. That’s because at the end of the day your investments are creating income for you without you being there working. Welcome to the concept of passive income. There are generally three ways to generate income. These are sorted out as earned income, investments, and passive income. Today, we’ll focus on creative ways people are setting up passive income. But first, let’s briefly cover the different types of income.

Earned Income

Earned income happens when you exchange labor for money. This is one of the most common ways to create income. Most often, your labor is compensated as wages, tips, salary, commission, and bonuses. The key takeaways to earned income are that your time and the value of your labor dictate how much you can make. We all have a set amount of time that we can devote to work each day. This means that the value of labor is an important variable for earned income. However, passive income is our goal so let’s move on to investing.

Investing Income

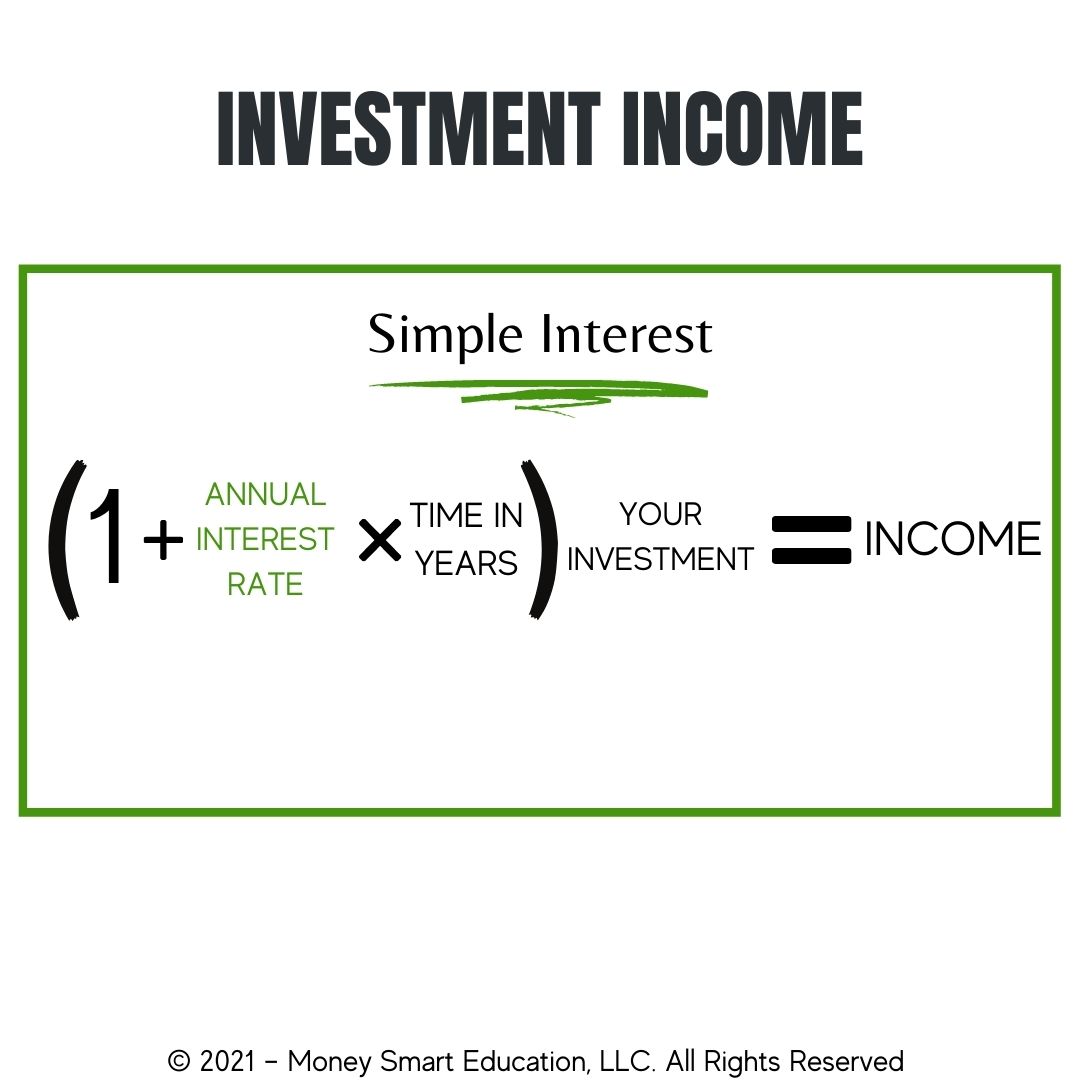

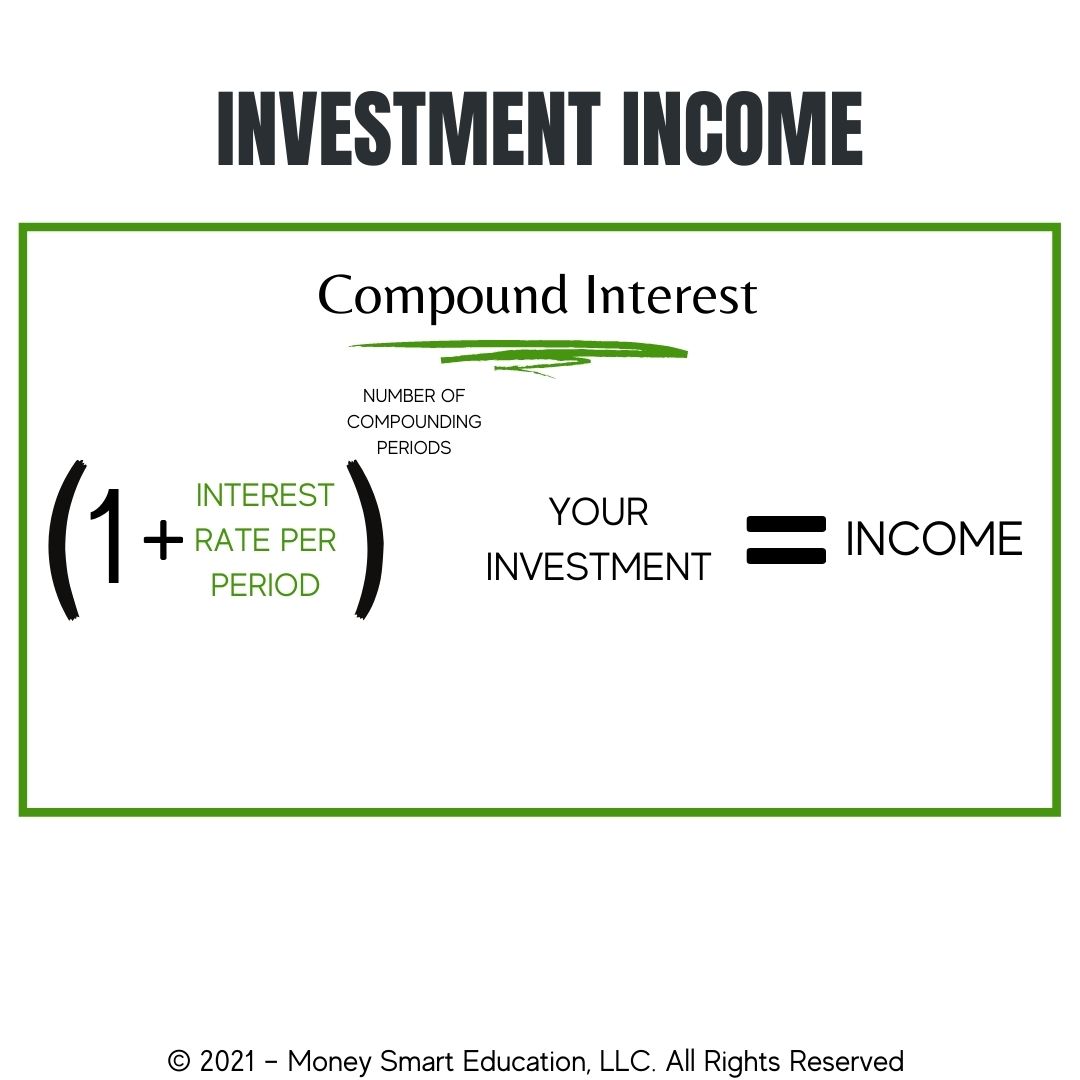

An investment happens when you let someone borrow your money under the condition that they pay you back – along with compensation for the amount of time they have your money. Investments can become creative in and of themselves but that is the concept behind investing. The most common ways to be compensated for lending out your money include interest, dividends, capital gains, and equity.

The key takeaways to investing are as follows. First, your money grows overtime based on the terms you and your borrower agree to. Second, all investments assume a level of risk and reward. Investments create value over time based on the terms and interest rate. This means that it’s important to be comfortable with the terms and interest rate of your investment based on the level of risk you are willing to assume. However, most investments don’t qualify as passive income; they are considered assets that increase in value.

Enter to Win $25!

Subscribe and share The Book on Money Management for a chance to win a $25 digital gift card.

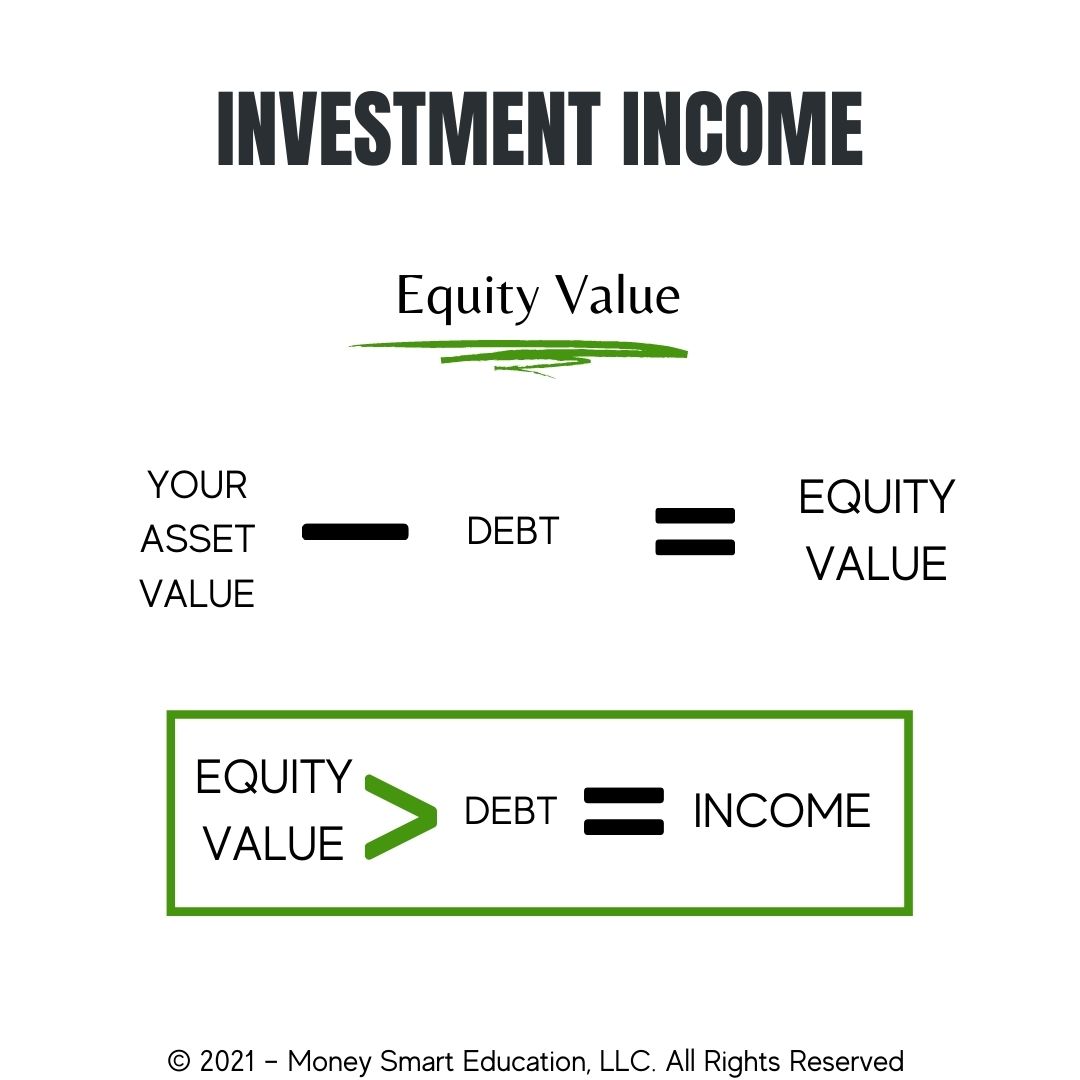

Equity is a bit different. Equity happens when you take on debt to acquire an asset. The goal is to have the value of the asset exceed the debt taken on when buying the asset. A great example of an equity investment is taking out a mortgage to buy real estate. The investor buys the real estate with the expectation that the future value of the real estate will offset the mortgage for a nice return. Understanding how to predict whether that asset will increase in value is very important. But that’s enough about investing, so let’s talk about passive income.

Passive Income

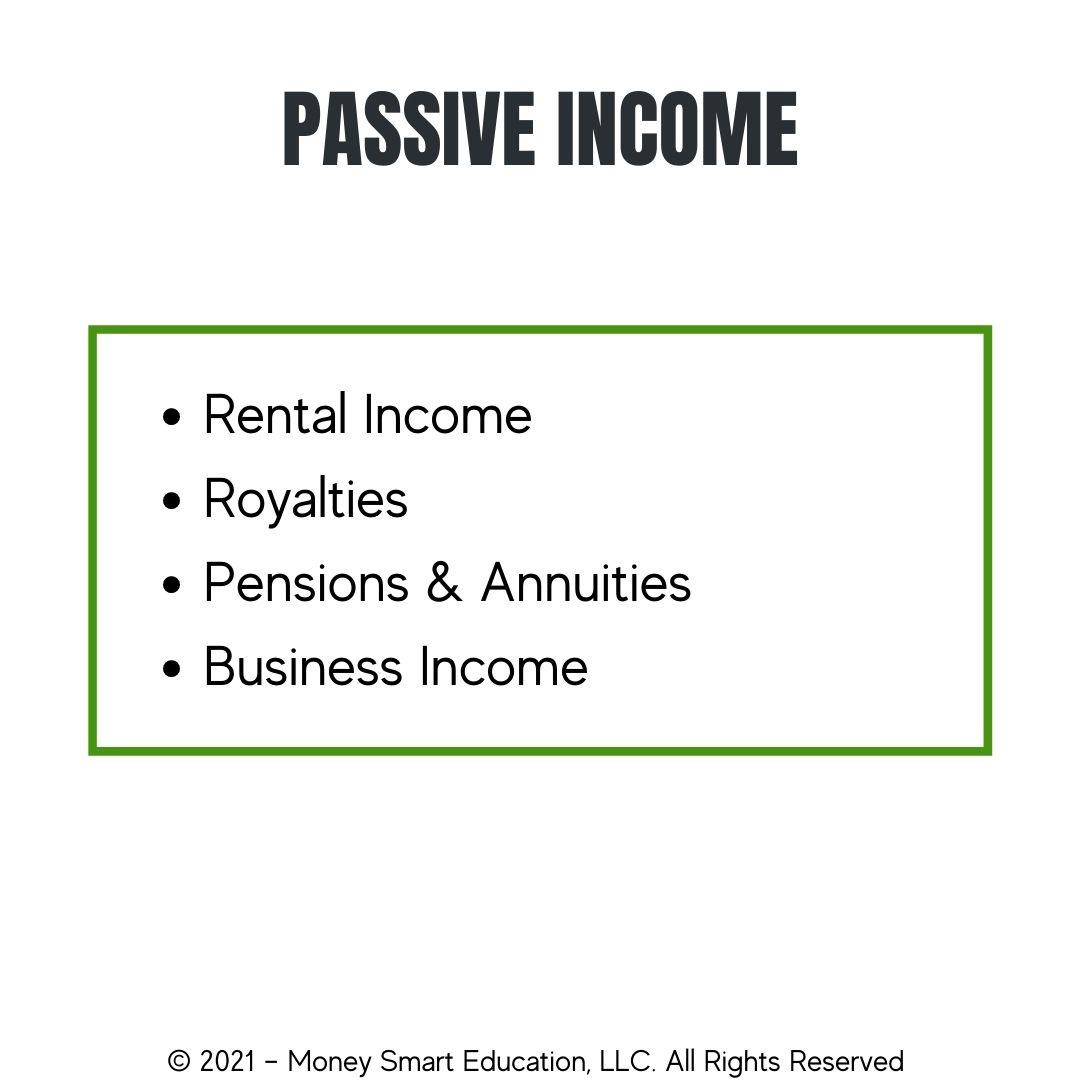

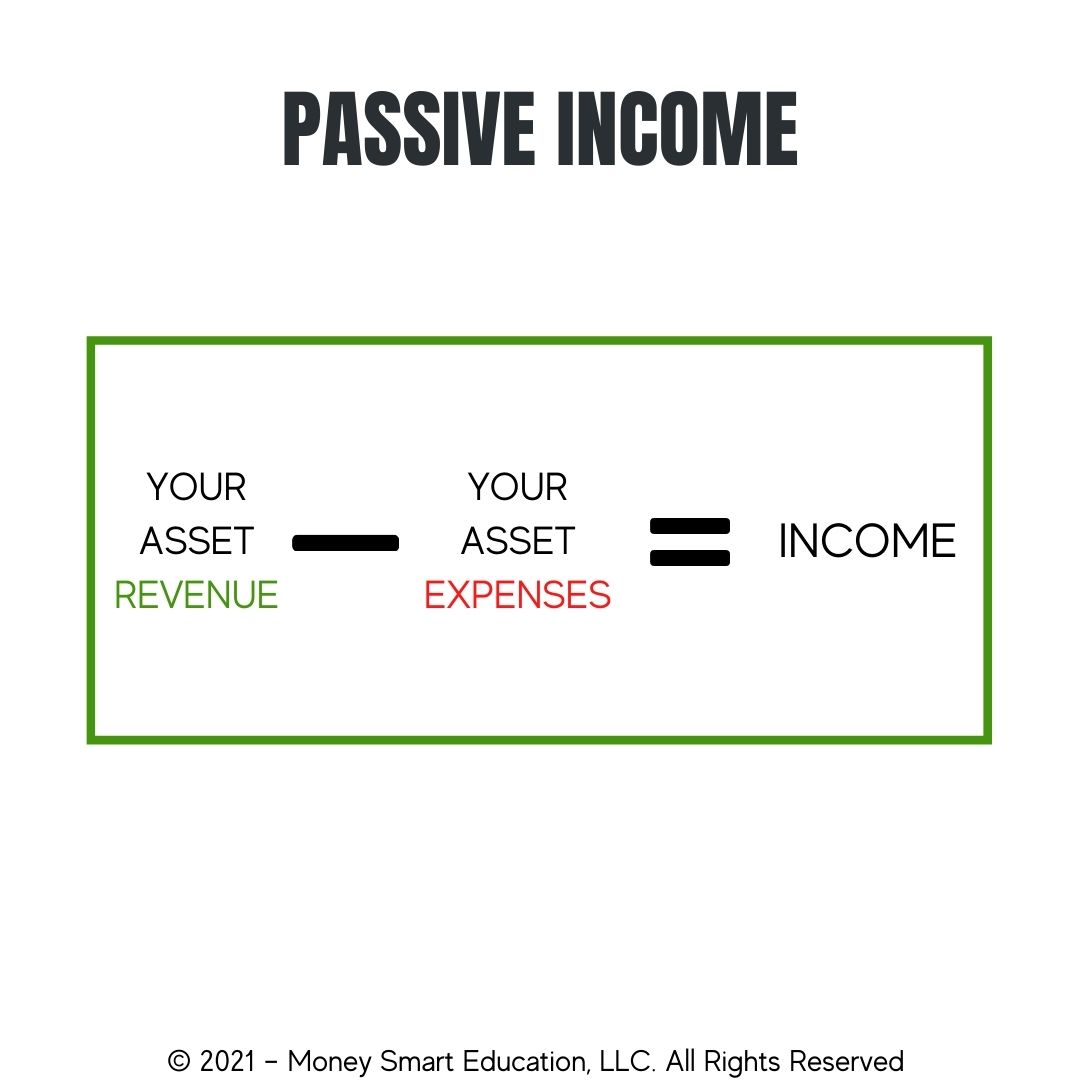

Passive income happens when the assets you own generate positive cash flow for you. Like investments, there are many creative ways to set up passive income streams. The important thing that distinguishes passive income from earned income is that you’re not exchanging labor for this income. And unlike investments, passive income generates passive cash flow for you. Some common income sources for passive income include rental properties, royalties, pensions, annuities, and business income. The key takeaway for passive income is that your asset is producing positive cash flow for you. With that out of the way, let’s look at some creative ways people are generating passive income.

Affiliate Programs

Affiliate marketing programs work by having a third party generate sales for your product or service in exchange for a share of the sales revenue. You may already have a great product or service that’s just waiting to make a positive impact in people’s live far beyond what you can do yourself. This can be an efficient way to spread the reach of your product or service while generating passive income. There are a variety of platforms and services that help make running your affiliate marketing program a breeze. I recommend that you learn and understand as much as you can about running your own affiliate marketing program if this sounds interesting to you.

Rental Properties

Renting out your property for others to use is an excellent source of revenue. Many of these options range from Air BnB to hiring a company to manage your tenants. The possibilities extend even further with people renting out their cars, storage space, and more. If you own it, chances are that somebody wants to rent it. Think about things that you own but never use; would you rent it to someone else for passive income?

Sell Your Knowledge Online

Think about something that you’re skilled at. Have you ever considered teaching it to others? An online course, book, or monetized YouTube video is a great way to generate passive income. It’s a big world. There are likely tens of thousands if not millions of people who would like to know what you know. If helping others succeed makes you happy, consider sharing your knowledge. It’s a great way to generate passive income.

Licensing Your Ideas for Others to Use

Did you create a new way of doing things, invent a tool, or develop an app that others can use? You can allow people to have access to your creation while generating revenue. This happens all the time in the background. Whether it be music, artwork, a process, or software, your intellectual property is valuable for you and for others. Take a moment to document your idea and understand who would be willing to pay you for continued access to it. You may discover a source of passive income.

Retirement Annuities & Pensions

Retirement plans are an important source of passive income when you’re retired and no longer working. Are you making the most of your employer’s retirement or pension plan? Retirement savings plans and pension plans are often overlooked as a source of passive income. Learn about your options and consult with a financial advisor so that you can make the most appropriate decisions around your retirement account.

Enter to Win $25!

Subscribe and share The Book on Money Management for a chance to win a $25 digital gift card.

Start Creating Wealth with Curtis Banks

Book a free discovery session with personal finance coach Curtis Banks and unlock your path to build wealth.