Wealth Mentor Curtis Banks Shares His Managing Money Tips

by MSE Staff | Published 6 Nov 2021

Managing your money can be a challenge. It is not always easy to stay on top of the daily tasks that are required for managing your wealth. Curtis Banks, Wealth Mentor and Financial Educator, shares his Managing Money Tips with readers in order to help them manage their finances better. For those who want to build wealth, this article will give you some great tips that will help you get there faster!

Money Tip #1: Personal Development

Your ability to make sound financial decisions depends heavily on your financial knowledge and skills. This is known as your financial capability. A big part of your financial capability is your personal development. This includes things like improving your knowledge about finance, learning new skills and building better habits that will lead you to success in the long run.

Money Tip #2: Schedule Time to Review Your Accounts

Imagine you're reviewing your bank statement for the first time in over 6 months, and you notice that fraudulent charges started occurring 4 months ago. You promptly place the account on hold and attempt to get your money back. However, you may not get any of your money back if you report it beyond the 60-day limit according to the FDIC. This reporting timeline may change from country to country. However, it's important to review your accounts well within that timeline. There are a plethora of free calendar apps available that you can use to set reminders. Carve out time and honor it. Review your accounts regularly for accuracy.

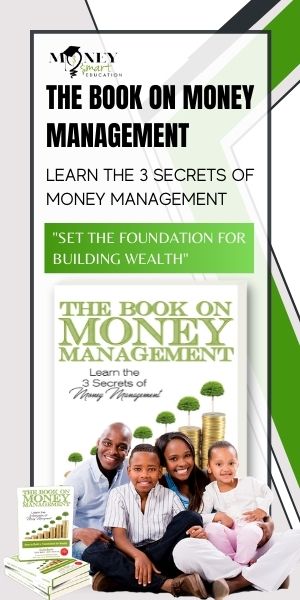

Enter to Win $25!

Subscribe and share The Book on Money Management for a chance to win a $25 digital gift card.

Money Tip #3: Automate Your Money Management System

You've created a money management plan using Curtis Banks' Money Smart Allocation System. Depending on the payment options provided by your employer you may be able to have a portion of your income automatically deposited to meet your savings goals. As for your banking institutions, they may offer automatic transfers and automatic bill payment. All of these tools are useful in helping you manage your money and avoid fees.

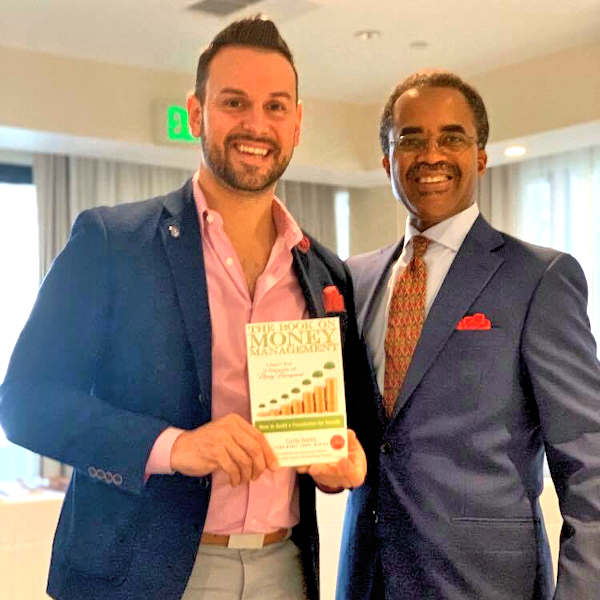

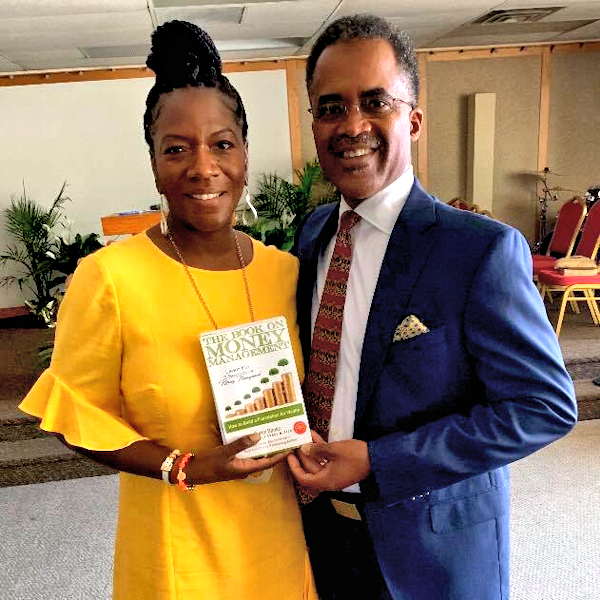

Money Tip #4: Wealth Mentor (Your Team)

Managing money tips are an excellent resource for building financial awareness. They provide broad educational benefit to readers. A wealth mentor goes above and beyond providing education and resources specific to your individual needs. Because a wealth mentor is someone who has accomplished what you have set out to achieve, a wealth mentor is an indispensable member in your team of experts.

Have you identified who your wealth mentor could be? Curtis Banks has mentored tons of people on how to build wealth. If building wealth is one of your goals, feel free to book a discovery session to learn more about working with Curtis Banks.

Money Tip #5: Payoff Credit Cards Monthly

Curtis recommends that you pay off your credit cards every month to avoid carrying over a balance. This is an important strategy to avoid paying more and more money on interest. By paying off your credit cards every month you're freeing up money for growth opportunities. Additionally, keep each credit card balance within 25% of their credit limit and do not exceed 25% of your total credit limit. Your utilized credit shows up on your credit report and ultimately affects your credit score.

Money Tip #6: Have Adequate Insurance

Insurance is meant to protect you from financial hardship when pre-defined conditions occur. Insurance is a financial product with a variety of options in the marketplace. There are a variety of insurance products ranging from unemployment to healthcare and beyond to help reimburse you. Be a savvy shopper. Shop around for products that offer you an adequate amount of protection at an optimal price. Revisit your plan periodically to ensure that you're getting the best coverage and the best rates.

Money Tip #7: Buy Cash Producing Assets (Passive Income)

Do you plan to work forever? While the type of assets you purchase to grow your net worth should align with your financial goals, it's important to focus on assets that pay you in addition to growing in value. The benefits of cash producing assets have a snowball effect as you buy more and more. It is possible to replace earned income with income from cash producing assets. This can translate to more freedom to pursue other passions you have. Talk to your team of advisors and make a plan for passive income.

Money Tip #8: Grow Your Network

It's said that we are the sum of our social circle. Growing your network of mentors and mentees aids in the personal development of you and those around you. Don't limit yourself by being an island, look outside your immediate circle and expand on the wealth around you so it can be passed down to the next generation.

Money Tip #9: Leverage Tax Deductions

Working with a credible tax advisor and tax preparer can help you keep more of the money you make. Curtis Banks says that it's important to plan ahead and keep a record of deductible transactions. It's important to note that every tax situation is different. Please consult with your team of experts on how this applies to you and your unique financial goals.

Money Tip #10: Be A Savvy Shopper

Curtis says that being a savvy shopper is an important money management tip. Chances are the thing that you’re interested in purchasing is available at a better price from another seller. Comparing prices can save you money. Finally, be patient when shopping. The things you want to buy will still be there in a few days or weeks if you’re willing to wait for the price to go down.

We hope that you have found this article helpful in your journey to better manage your finances. If you want help from a wealth mentor who understands the challenges of managing money, we invite you to book a free discovery session with Curtis Banks. He is looking forward to meeting with you and helping make it easier for all those who are seeking financial freedom!

Start Creating Wealth with Curtis Banks

Book a free discovery session with personal finance coach Curtis Banks and unlock your path to build wealth.